Abstract

Nowadays there are the gas pipelines with total capacity of 113.5 bcm in Europe that are at the active stage of construction or design. The projects geography is vast: from the polar latitudes of Norway to the Caspian Sea. Besides, against the background of excess capacities of regasification LNG terminals in Europe new gas pipelines are implemented, which are used today less than 50% notwithstanding the growth of LNG supplies by the global markets. Gas pipelines shall retain role of energy security base they are playing even while Europe experiences its energy transfer – however, their role can expand.

Keywords: gas, gas hub, gas pipeline, gas transit.

Annotation

Currently gas pipelines with a combined capacity of 113.5 bcm in Europe undergo an active stage of design and construction. The geography is vast – from polar latitudes of Norway to the Caspian Sea. New pipeline projects are implemented notwithstanding that the excessive capacities of currently being used European LNG regasification terminals are still below 50% on the wave of growing LNG supply from the global markets. Gas pipelines are to preserve the role of energy security instrument in the face of European energy transition, however, their functionality can significantly expand.

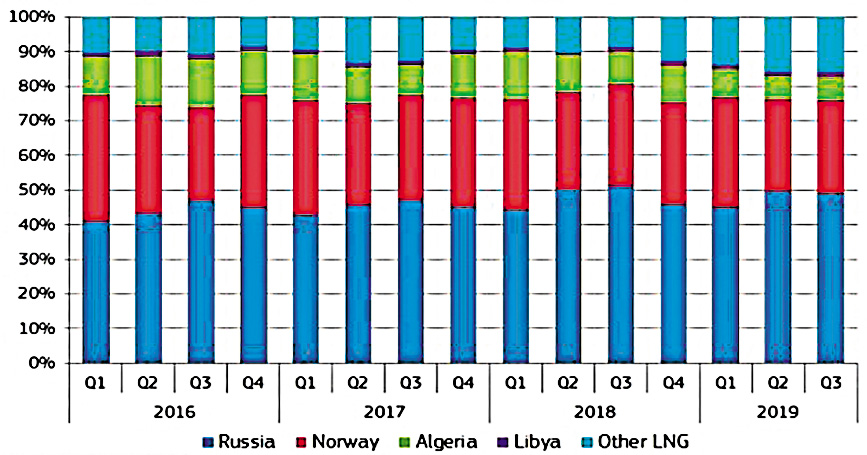

European gas market is unique nowadays. It covers both wide range of pipeline gas import opportunities and powerful potential of liquefied natural gas usage (Fig. 1). In general, the capacities of main export gas pipelines of Russia, Norway, Algeria, Libya are quite enough to cover the European market requirements for natural gas even in case of lack of own production in Europe. However, due to various reasons, including those of strategic nature, the greater part of gas pipelines are not used with their maximum capacity. The Ukrainian gas transmission corridor is illustrative, since at its rated capacity of 180 bcm at the Western border it is used by less than a half, and not only because of complicated political situation, but due to merely technical reasons as well.

Besides, the European capacities for the network R-LNG supplies amount to 235 bcm, but in 2019 only 40% of them were used (Fig. 2).

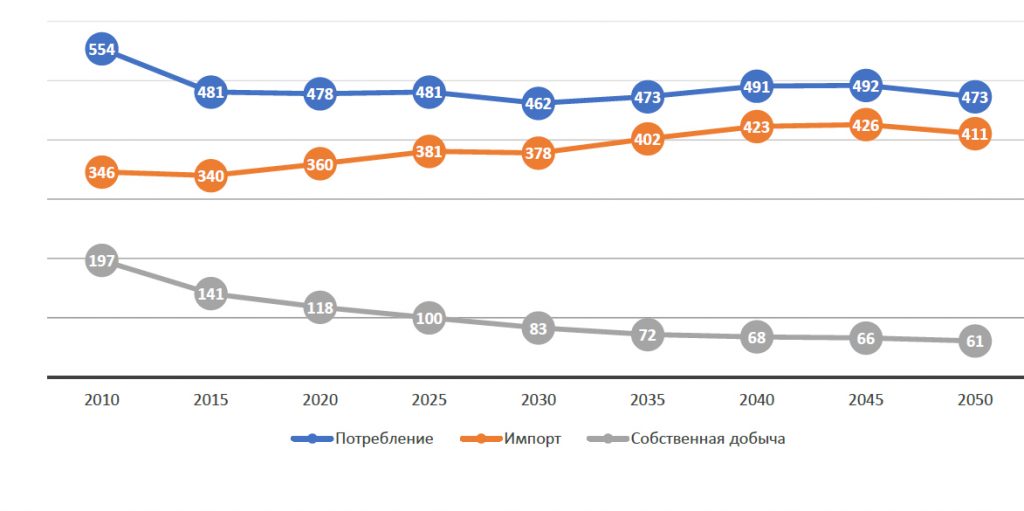

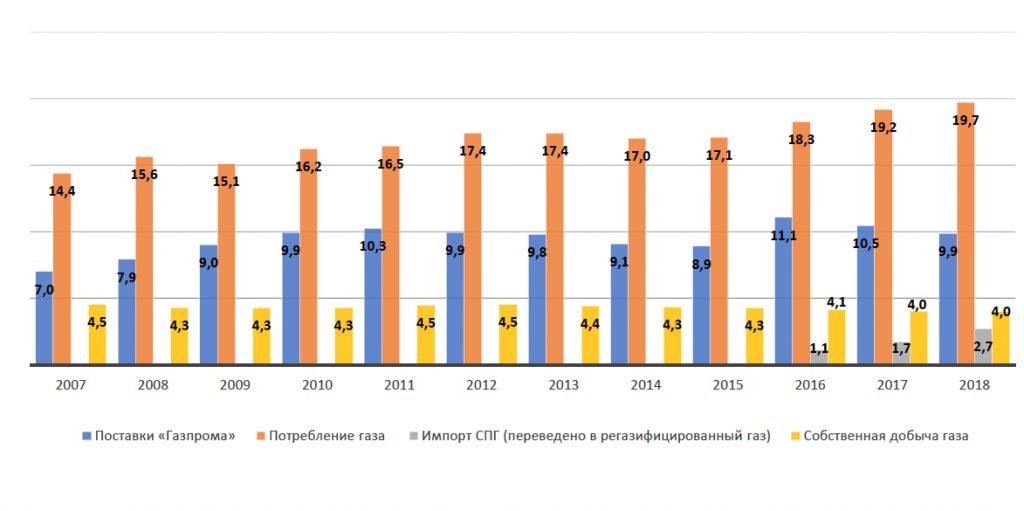

Taking into account the growing European trend of own gas recovery decreasing (Fig. 3), the region requirement for import gas increases simultaneously. Besides, the European flow directions are changing, the consumption centers are shifted, some regions in line with diversification seek for alternative sources of energy and new suppliers. As a result, new gas pipelines construction projects appear on the apparent spill-over market of capacities.

Nowadays the gas pipelines with total capacity of 113.5 bcm are actively of launched, constructed or designed. First of all, these are definitely the Russian projects Nord Stream 2 and Turkish Stream, recently put into operation, and the Southern Gas Corridor from Azerbaijan (TANAP and TAP gas pipelines), Baltic Pipe gas pipeline from Norway, high-capacity surface main gas pipelines on the territory of Germany, as well as the theoretical projects of Eastern-Mediterranean and Turkmen gas supplies.

Nord Stream 2 and opening growth in the North-West Europe

For the benefit of Russia Nord Stream 2 gives the possibility to supply gas to the main consumption centers in North-West Europe in future decades without any transit risks (modern gas pipeline operational lifetime can be up to 50 years). Owing to this project Germany can become the largest gas transit country in the world. Upon Nord Stream 2 project implementation up to 150 bcm of gas (supply or transit) will pass through Germany annually.

Certainly, this is both Germany gas transmission operators’ benefits, and more favorable gas prices comparing to other countries downstream the transport chain. No doubt, the participation of European Gazprom partners in the gas pipeline project is commercially profitable, since they obtain their profit from project financing.

Meanwhile, the equity gas production is reducing in Europe. Particularly this trend is observed on the North-West of the region. The Netherlands, a pioneer country of European gas recovery and creator of the modern natural gas trading system, is planning by 2023 to stop the giant Groningen field recovery. Only five years ago this field produced more than 50 bcm of gas was produced on, and this volume was sent not only to the Dutch market, but also exported to the neighboring countries (Germany, Belgium, France). Production quota on this field for the current gas year is only 12 bcm (whilst in 2018–2019 it was about 17 bcm). The list of strategic EU projects includes the plans for gas distribution networks of Germany, France, Belgium re-equipping from low BTU gas of Groningen to the high energy gas (as the Russian one).

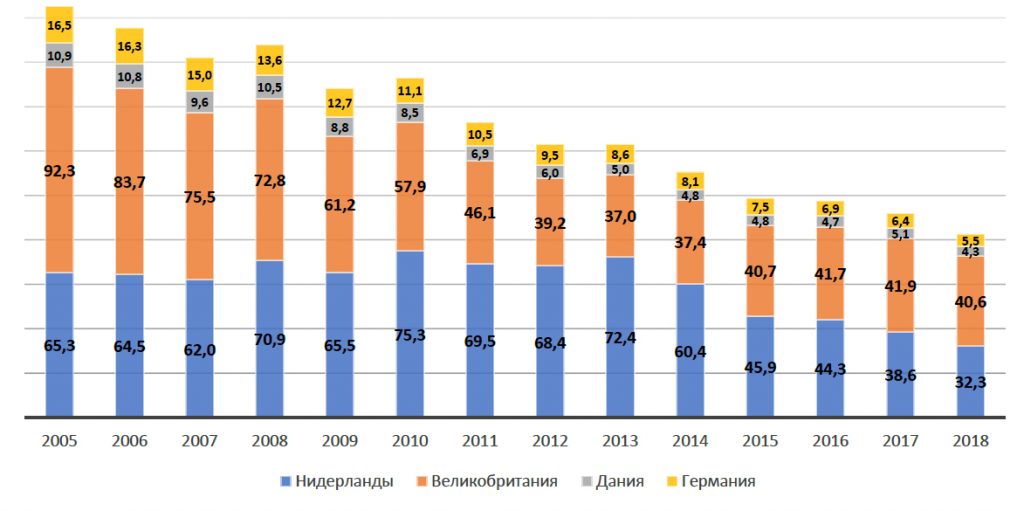

The production in the North Sea, formerly a breadbasket of European oil and gas industry, is also reducing. Denmark recently closed Tira field producing 90% of national gas till 2023 (Fig. 4). From 2005 the cumulative gas recovery in the Netherlands, Great Britain, Germany and Denmark reduced by more than 100 bcm. The majority of branch observers suppose that even Norway, being the second largest gas supplier in European Union, had reached its maximum of gas recovery (Fig. 5).

Besides the trend for replacement of coal and nuclear capacities with a gas one is observed. Last year due to low gas prices the volumes of gas generation increased by 10%, and as for coal vice versa – they dived a quarter.

As a result, notwithstanding the moderate growth of gas consumption in Europe in the forefront of renewable energy sector development, the region requires more import gas due to the reduction of own “blue fuel” production capacities. Therefore the construction of Nord Stream 2 gas pipeline turns out to be reasonable. Europe shall have no fear regarding the growth of gas supplies from Russia. Nowadays Europe is the only region in the world with the unique possibilities for pipeline gas and LNG importing; besides, within the last year Europe increased greatly the liquefied gas import from the global markets.

Certainly, the adoption of American sanctions against pipe-laying ships the complicated greatly the construction of Nord Stream 2. However, Russia has at least two ships that are capable to complete the works: Fortuna barge, which was laying the gas pipeline on the Baltic shallow waters and Academic Chersky vessel, which is located in the Far East and first of all designed for Sakhalin projects. Further fork of scenarios with further gas pipeline construction will depend on the project operator. Meanwhile, the support of German industrial and political circles can be expected after the transit contract signing with Ukraine.

Ground extensions of Nord Stream 2 in Germany

By early 2020 first transit string of Nord Stream 2 overland extension – EUGAL gas pipeline, which will go from Greifswald to Deutschneudorf on the border of Germany and Czech Republic, in parallel to the existing OPAL gas pipeline route. 45.1 bcm of gas will be transited annually to Czech Republic and 9.9 bcm – to the west of the country via Germany GTS over EUGAL gas pipeline. The aggregate pipeline capacity is equal to the Nord Stream 2 and amounts to 55 bcm of gas per year. Operators’ investments into two-string gas pipeline project are estimated to be 3–4 bln Euro.

Last year the events developed actively with regard to one of two first Nord Stream overland extensions – OPAL gas pipeline. However, 50% of Opal capacity at the exit point from Germany to Czech Republic was blocked for usage by Gazprom by the decision of European Court.

Nevertheless, in September this blocking did not create any catastrophic problems for the concern. Court order was fulfilled precisely and the transfer stream to Czech Republic was reduced twice. However, at the entrance to Greifswald the volumes remained virtually the same due to the increase of gas supply to NEL gas pipeline and to German GTS. Thus the Nord Stream load factor remained unchanged.

Untill the completion of Nord Stream 2 construction the first EUGAL gas pipeline string is used for transit gas supplies to Czech Republic. With the help of new German gas pipeline Gazprom can carry out the transit supplies in full without any restrictions, with no regard to OPAL blocking.

Strategic Turkish Stream gas pipeline

Certainly, the Black Sea marine gas pipeline is strategically important for both Russia and Turkey. And we are talking now about the development of strategic alliance of Moscow and Ankara, both in energy sector and in strategic issues of security and international relations, rather than commercial issues of gas trading. This project helps Russia to obtain the non-transit gas route to Turkey market, and the role of the country transiting gas to Europe transfers to Turkey, with which Russia has much more perspectives for strategic dialogue, rather than with Ukraine. Turkey, in turn, becomes an actual gas hub. Nowadays the country has access to gas of Azerbaijan, Iran, two non-transit gas pipelines from Russia, as well as to LNG from global markets. The role of gas hub provides the country with tangible financial benefits both due to favorable gas prices and gaining profits from the transit.

Turkish Stream is aimed at substitution of the supplies to Turkey via Transbalkan gas pipeline (via Ukraine, Moldova, Romania, Bulgaria). However, according to Entsog data, in 2019 Turkey received over Transbalkan gas pipeline about 4.5 bcm of gas, which is more than twice less than in 2018 (11 bcm). In the current export behavior the demand of key project markets is not yet sufficient for full filling of first gas pipeline string, over which the Turkey, Bulgaria, Greece and North Macedonia supplies are carried out nowadays.

Certainly, various parameters of export dynamics can change. Weather factor can change abruptly, Gazprom can provide discounts for Turkish consumers or extend its electronic trading platform applicability for this region. And Turkey itself can increase the natural gas consumption in the power balance of the country, since from record-breaking 2017, when the “blue fuel” consumption was over 50 bcm, the gas demand in Turkey reduces. Among the European countries, which the Turkish Stream is aimed at, only Hungary demonstrates the most positive dynamics of Russian gas purchasing growth, where the connecting infrastructure construction project advances slowly, as opposed to, e.g. Serbia or even Bulgaria. However, after the completion of European extension of Turkish Stream and proposing more favorable conditions for Turkey Gazprom will definitely count for new gas pipeline filling at a design level.

Turkey will be the biggest beneficiary party of the project implementation among the foreign partners of Russia. Under the big packaged energy transaction with Russia Turkey turned out to be a large gas hub in Turkish Stream project, and obtained the discount for gas for Botas national company. However, any country is interested in participation in gas transmission project on this scale. This project provides the positive effect for national economy not only on the gas infrastructure construction or modernization stage, but even upon its completion due to the transit income to the budget over the decades. Thus, the Bulgarian GTS operator announces the auction for the capacities of future section of gas pipeline reservation for 20 years – during this term the country will reliably obtain the transit payments. Besides Bulgaria the European section of gas pipeline will go through Serbia, Hungary, Slovakia and Austria – these countries also will gain the benefits from gas transit in the course of gas pipeline to the Central Europe construction.

From polar latitudes

As for Norway, the second major natural gas supplier of Europe, it managed to obtain on the background of stagnating fields of the North and Norwegian Seas a young and prospective hydrocarbon province in the southern part of the Barents Sea. According to the assessment of Norwegian Petroleum Directorate, 37% of undiscovered gas resources on the shelf of the country can lie in the southern part of the Barents Sea, and another 29% – in the northern one.

Currently an active development of Snøhvit (from which the gas is supplied to LNG facility in Hammerfest) and Goliat fields is implemented there. At that, nowadays Snøhvit field is the only export-oriented field (produces about 6.5 bcm of gas per year); the gas recovered at Goliat field is injected back into the formation. However, the potential of gas recovery in the region shall improve substantially during the nearest five years due to Johan Castberg, Alke, Wisting, Alta and Gohta fields commissioning.

The capacity of Hammerfest LNG-plant alone is not enough for monetization of all gas resources of the region. That is why operating companies of the projects on the Norwegian shelf consider the possibility of construction of gas pipeline with the capacity of 10–20 bcm per year and linear expansion of about 1,000 km up to the existing export gas transmission network in the Norwegian Sea. However, the implementation of this project is quite expensive, and the options of current LNG production modernization or construction of new plant of a small capacity are analyzed as well.

To Southern corridor

The system of Trans-Anatolian (TANAP) and Trans-Adriatic gas pipelines (TAP) is the part of EU supported big gas transmission project of “South Gas Corridor” (with the capacity of 16 bcm). Under the scope of this project the gas from Azerbaijan field Shah-Deniz 2 will be supplied to the markets of Turkey and Southern Europe. The supplies to the Turkish market started in 2018 and at peak will amount to 6 bcm.

It is planned that the supplies of Azerbaijanian gas to the markets of Southern Europe will start in 2020 and will amount to 10 bcm at peak. With these supplies Bulgaria will be able to satisfy about one third of its gas consumption, Greece – one fifth and Italy – about 10%.

Until now the construction of gas pipeline Turkish section extension on the territory of Europe – Trans-Adriatic gas pipeline (TAP) (from the border of Turkey, via Greece and Albania and further via the Adriatic Sea to Italy) had not been completed yet; nowadays it is impossible to start the supplies to Europe.

Earlier they talked about the possibility of South Gas Corridor expansion in future. Within the conditions of lack of resources availability in Azerbaijan and uncertainty about new players (such as Turkmenistan and Iran) involvement in the project, the Russian participation can be admitted as a potential at late stages of project implementation.

Poland Diversification

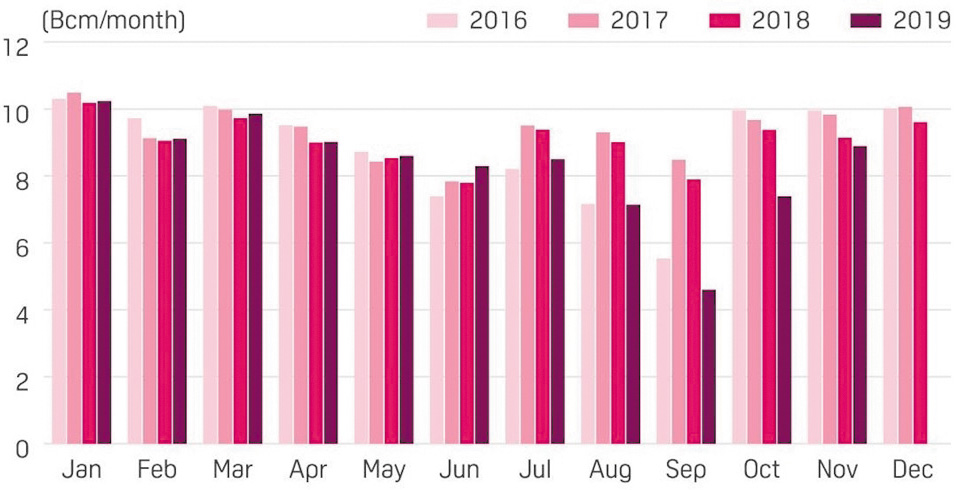

In November Polish State Company PGNiG notified Gazprom about its wish to discontinue the Russian gas purchasing upon the termination of the contract in force in 2022. Indeed, over the last couple of years Poland had made significant efforts in the sphere of gas supply sources diversification (Fig. 6).

In addition to LNG deliveries from Qatar, the contractual volumes of which amounts to 2 mln tons per year, PGNiG has significant contracts and memorandums with US liquefied gas manufacturers in a volume of about 7 mln tons per year mainly starting from 2023. Thus, starting from 2023 the LNG purchases of PGNiG can exceed 9 mln tons per year (over 12 bcm). At that, the capacities of the only Polish LNG receiving terminal in Świnoujście even after expansion will be only 7.5 bcm of gas per year. Potentially the capacities of regasification in Poland in the middle of 2020 can grow due to the construction of FSRU in the port of Gdansk with the capacity of 4 bcm per year. However, even in case of potential growth of receiving capacities it is essential to recall that PGNiG is planning to develop its own subdivision for liquefied gas trading, that’s why there are no guarantees that the whole volume of LNG will go to the domestic market of Poland.

Baltic Pipe project is aimed at the provision of stable gas supplies to the Polish market in case of refusal from Russian raw material. Gas pipeline will start in the southern part of Norwegian shelf of the North Sea, go through the continental Denmark and further via the Baltic Sea to Poland. Annually up to 10 bcm of Norwegian gas will be supplied via the gas pipeline from 2022–2023.

On the surface it seems that upon the contract with Gazprom termination Poland can “close” its consumption (in current figures) with the help of LNG and Norwegian gas. However, as usual, there are important nuances here.

First of all, Poland market is one of few markets to the East from Oder with a substantial potential for gas demand growth. According to the Polish Company Gaz-System optimistic forecast scenario, the volume of gas consumption in Poland can amount to about 27 bcm by 2023 and continue to grow up to 2040. The negative scenario foresees the preservation of current volumes of consumption. The production potential of PGNiG on 24 licenses on the Norwegian continental shelf amounts to 2.5 bcm per year after 2022. It is necessary not only to find the source of these fields financing, but also physically bring them into operation and provide the declared gas volumes.

Secondly, the intent to transform GTS countries into an important gas hub had been declared in Poland on the official level. Poland develops the systems of interconnectors almost with all neighboring countries – and such experimental projects are implemented hereas gas supplies via LNG terminal to Ukraine. If it is worth refusing the essential supply source from the East in the courses of declaring the intent of hub development is highly questionable. Since the concept of hub itself foresees the availability of as many suppliers as possible.

Thirdly, it shall be understood that the prices under the contracts with Gazprom increasingly reflect the quotes of public markets, and there are no any restrictions for reexport. Gazprom develops the spot supplier direction with the help of its electronic trading platform. Actually this means that within the limits of spot sales the prices of Gazprom and prices of Norwegian Equinor will differ substantially (and own PGNiG production will not be enough for Baltic Pipe filling). Until now Gazprom actually did not propose any lots with gas supply via ETP to Eastern Europe. However in future it might quite well propose the gas with delivery to the points in Poland.

In any case, it is too early to put an end to Russia and Poland gas cooperation. The history of these two countries cooperation and conflicts is one of the longest in Europe in a scale of gas trade terms. And we talk not only about supplies, but about Russian gas transit via gas pipeline Yamal – Europe as well, which will continue even in case of Gazprom gas import to Poland cessation. Besides, in case when the authorities and industry of Poland are planning to create an important gas hub, it is too early to refuse from the cooperation with Gazprom. Certainly, the form of cooperation will change, since by law coming into effect in 2023 Poland will not be able to import more than one third of gas from one source. But also this “one third” in the long-term period in case of cooperation continuance (e.g., in the form of deliveries via ETP) and Poland market growth can turn out to be quite comparable to current export indicators.

Mediterranean lump

At the beginning of January 2020 the President of Cyprus Nikos Anastasiadis and the Prime Ministers of Greece and Israel Kyriakos Mitsotakis and Benjamin Netanyahu signed the agreement on construction of EastMed gas pipeline, which shall transfer the gas recovered on the fields of Levantine oil-and-gas bearing basin in the waters of Israel and Cyprus to Europe. Route of 1,900-kilometer gas pipeline shall goes along the Eastern Mediterranean through Cyprus and Crete on continental Greece and further connects with the projected Poseidon gas pipeline in Italy. The gas pipeline estimated capacity is 12 bcm. The scheduled project implementation value of 6–7 bln dollars looks optimistic, taking into account the distance of the gas pipeline and sea depth (up to 3,000 m) on the route. Besides, nowadays there are no trunk gas pipelines of such length and in such depths. The deepest trunk gas pipeline is Blue Stream from Russia to Turkey (depths up to 2,150 m), the gas trunklines were built in the Gulf of Mexico at the depths of about 3,000 m, but such combination of deep dwelling and long route appears for the first time.

There is a trove of political difficulties regarding the gas pipeline project. The number of analysts at once named the signature of a project agreement to be a “triumph of American diplomacy”. Indeed, USA expressed the support to the project at all times during its implementation (for the first time the idea of its present form was announced in 2013). And inter-governmental agreement among Greece, Cyprus and Israel was signed in spring 2019 with witness of US Secretary of State Mike Pompeo. For USA the support of energy infrastructure projects construction in the Eastern Mediterranean is not only the issue of political relations with allies reinforcements in such a difficult region, but also the declaration of objective for support of Europe efforts aimed at supply sources diversification.

Such energy diplomacy riled other major players in the region. Thus, the Prime Minister of the Turkish Republic of Northern Cyprus Ersin Tatar declared that the project would not be implemented without Turkey approval. Earlier on repeated occasions the Turkish Navy ships undermined any attempts of exploration wells drilling in the exclusive economic area of Cyprus. Egypt, which after the commencement of Zohr field production and signing the contracts for Israel gas import also became an important gas player in the region, supported the project verbally. However, in fact Cairo promotes its own agenda, which foresees the Egypt transformation into a regional gas hub due to deliveries of Eastern Mediterranean gas to two Egyptian gas liquefaction plants for further export to global markets. Italy, which, as it is planned, will be the key sales market for gas pipeline, also expressed a mixed reaction. Thus, the Minister for Foreign Affairs Luigi Di Maio named the value of the project “prohibitive”. Besides, there are the disagreements between the Italian supporters of this project and those of TAP gas pipeline under construction (which also provoked a lot of arguments).

Turkmenian dreams

Projects of Turkmenian gas supplies to the European markets lead a history of their own from the beginning of 1990. At different times the variants of gas supplies from Turkmenistan to European markets via the Caspian Sea and further by the planned projects of Nabucco or White Stream gas pipelines via Trans-Caucasus and Turkey to EU were discussed. None of the projects turned into reality. Formerly the undefined status of the Caspian Sea obstructed the ideas of gas pipeline infrastructure construction over the Caspian Sea. The challenges for implementation of such project mainly lay within the context of multi-billion investments.

Besides, Turkmenistan supplies about 40 bcm of gas to China via triple pipe gas line, implements the fourth string construction project. The construction of “Turkmenistan – Afghanistan – Pakistan – India” (TAPI) gas pipeline lasting for many years continues. In case of construction completion up to 33 bcm of Turkmenian gas will be supplied over this pipeline. Gazprom resumed purchasing of Turkmenian gas in the amount of up to 5.5 bcm per year. In such conditions, even if there are investors, that are ready to invest heavily in trans-caspian energy, the issue regarding the resource base for such project remains unsolved. Notwithstanding the great number of issues this project remains in the list of EU priority projects.

Energy transfer as an opportunity

The important feature of gas infrastructure created in EU is its future conversion into the route for methane and hydrogen mixtures and clean hydrogen deliveries at the later stages. However, currently all plans and strategies in this sphere are implemented by business and communicated by industry organizations. There is often another inquiry from the part of political Europe –transfer to carbonless forms of energy. Hydrogen can serve as sort of arbiter, reconciling both camps, since from one hand it can be obtained from the natural gas and supplied over the existing GTS, from another hand it is an appropriate representative of low-carbon energy.

Earlier the specialists of Gazprom and Uniper informed that the modern gas pipeline, such as Nord Stream 2 can receive the methane hydrogen mixture with the content of hydrogen up to 80%.

In 2018 the Dutch company Gasunie published Forecast 2050 research, in which it presented the vision of possible ways of achieving the reliable and accessible deliveries of СО2-neutral energy in the Netherlands by 2050. According to the proposed concept the use of existing pipeline infrastructure for transportation of hydrogen, obtained from the natural gas or RER energy turned out to be more efficient than the creation of new networks for electric power transfer.

In 2018 the innovative power system was put into operation in small French town Cappelle-la-Grande, Dunkerque region. New equipment allows to transform the surplus of electric power obtained from the renewable sources into hydrogen, which is further injected into the gas distribution network. The share of obtained in such a way hydrogen in the energy systems of the town will be from 6% to 20%. It was the first case of practical application of power-to-gas technology in France. On the opposite side of La Manche the project of energy systems of Leeds and other settlements of the Northern England transfer to 100% hydrogen is implemented. The project stipulates the exit to the national level and transfer of 12 mln of British households to the usage of hydrogen by 2050. It is assumed to use the existing gas transmission networks, which is extremely important for Great Britain, which is one of the European pioneers of gas recovery and gasification.

In future the underground gas storage sphere can transfer to the use of methane and hydrogen mixtures. Recently, the gas storage business is not bringing considerable outcome due to the fact that the difference of natural gas prices in summer and winter months reduced greatly. In some countries this led to the underground storages closure. However, in future this situation can change due to the hydrogen injection into the storages. Thus, the Austrian company RAG tested the hydrogen storage in a small depleted field in the Upper Austria. It was proved that the available infrastructure can successfully receive up to 10% of hydrogen.

Thus, even on the background of European energy transfer the modern gas pipelines, including new Russian projects as well, are well positioned to keep their essential strategic role in the provision of Europe energy security. Being a gas supplier, Russia has all capabilities not only to keep the status of the major gas exporter to the region, but to expand its positions in future with the help of delivery of new innovative forms of energy to conventional market.

References

1. Offshore Technology. URL: https://www.offshore-technology.com/projects/tyra-gas-field-redevelopment/

2. Gassco, Barents Sea Gas Infrastructure. URL: https://www.gassco.no/globalassets/099808.pdf

3. Monitoring of Gas Market of Energy Industry Center of Moscow Management School SKOLKOVO, June 2019. URL: https://energy.skolkovo.ru/downloads/documents/SEneC/Monitoring/SKOLKOVO_EneC_Monitoring_Gaz_2019-06.pdf

4. “EastMed won’t be realized without Turkish approval, Turkish Cypriot premier says”, Hurriyet, January 05, 2020. URL: http://www.hurriyetdailynews.com/east-med-pipeline-project-wont-be-realized-without-turkish-approval-turkish-cypriot-premier-says-150613

5. “Italy’s foreign minister expresses doubts over feasibility of EastMed pipeline”, Times of Israel, 18 January, 2020. URL: https://www.timesofisrael.com/italys-foreign-minister-expresses-doubts-over-feasibility-of-eastmed-pipeline/

6. Repetition of gas Crisis in Europe is Virtually Impossible, Prime, October 2, 2019. URL: https://1prime.ru/energy/20191002/830372591.html

7. Gasunie Infrastructure Outlook 2050. URL: https://www.gasunie.nl/en/expertise/system-integration/infrastructure-outlook-2050

8. H21 North of England Project. URL: https://www.h21.green/projects/h21-north-of-england/

9. “Gasspeicher als Gelddruckmaschine”, Der Standard, Günther Strobl 15. August 2018, Günther Strobl 15. August 2018.