Aleksey Rybnikov – рresident of the St. Petersburg International Mercantile Exchange

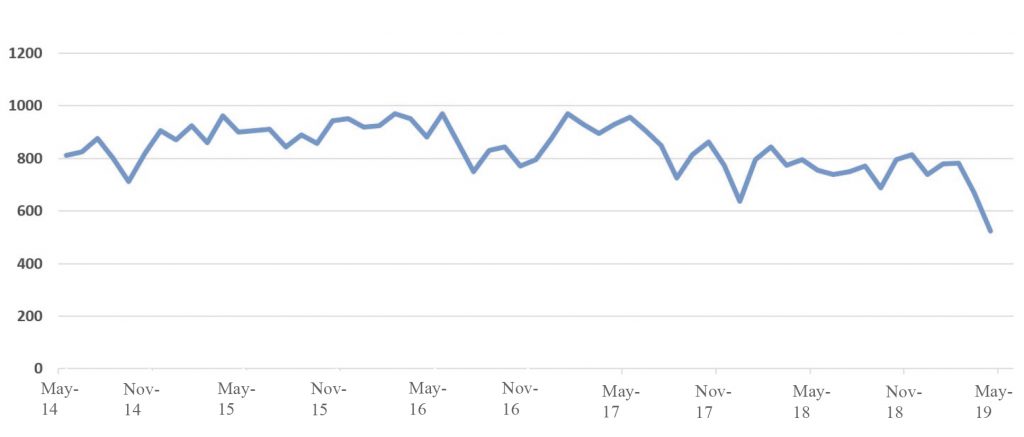

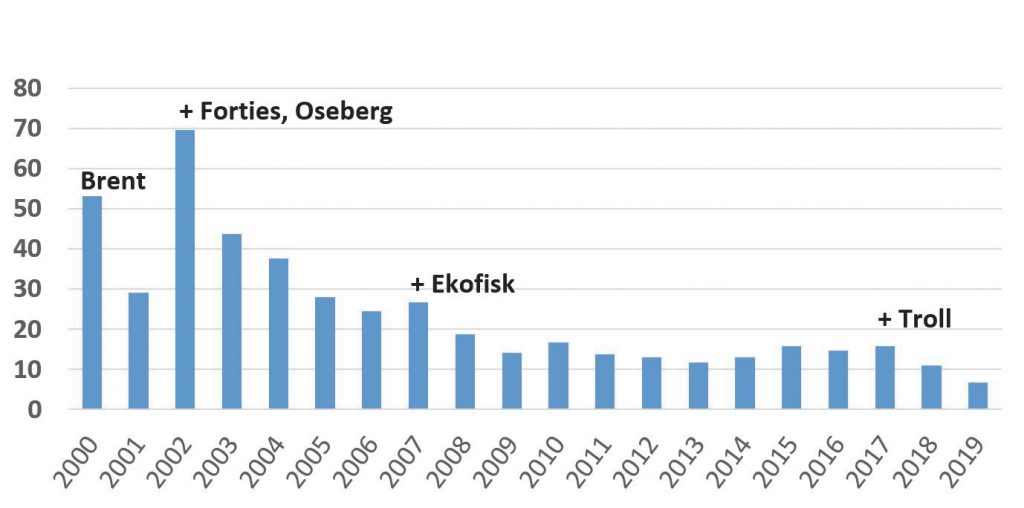

The pricing system on the world oil market, which has long taken its main cue from the price benchmark based on the North Sea BFOE, is currently facing a slew of problems and crises. In particular, the continuing decline in North Sea production that has persisted in recent years is forcing a constant expansion of this basket through the inclusion of more and more fields, which is leading to heterogeneous oil flows without solving the problem of reserve depletion, even in the mid-term (Fig. 1). Simultaneously, the number of deals involving physical barrels, on which the «estimates» of price agencies are based, is also falling (Fig. 2).

Source: According to Argus Media

Source: According to Argus Media

The lifting of oil-export restrictions by the United States at the end of 2015, along with the growth in oil production at shale fields, has led to additional problems for the Brent benchmark – stiffer competition with the North American WTI standard (West Texas Intermediate). According to available data, having successfully overcome many of the transport-and-logistics problems that existed along the US coast, export supplies of American oil to Western Europe have already hit at least the production level of the five grades included in the BFOE. In September, at the international oil-market conference in Singapore, market players discussed how quickly American oil exports could reach more than 4.5 mln barrels per day!

The entry of tens of millions of tons of American oil into the foreign markets is amplifying the importance of settling on the price standard that will serve as the basis for evaluating that crude. At issue is the fact that, for more than thirty years, the value of the oil sold within the United States has been determined based on the price of the fulfilment of obligations under «WTI futures contract,» a contract traded on the Chicago Mercantile Exchange (CME).

That said, the changes occurring in the pricing system on the global petroleum market are not limited to an exacerbation of the «Brent vs. WTI» fight. The world’s two largest oil importers (the European Union and China) are also getting involved in the fight. The European Union is considering the feasibility of launching a framework contract for oil denominated in EUR, and China has already launched a deliverable futures contract in CNY. All of this undermines the current status quo.

I believe, however, that the ongoing changes must be evaluated not only and not so much from the standpoint of which of the benchmarks will become more global. Such a statement of the question is primarily beneficial to pricing agencies, which, while fighting amongst themselves for leadership in this matter, nevertheless remain largely hostage to the old paradigm of thinking in terms of the technique for forming these very standards. The reason is clear – at stake is hundreds of millions of dollars in agency revenue from selling price information to market participants who, in turn, have long complained about its high cost and the lack of transparency in the generation of estimates. At the same time, it is interesting to note that regulators are in no hurry to pester the commodity market with the issue of forming price standards (benchmarks) on the basis of actually-concluded deals, although such an approach has long been proclaimed the only correct one on the financial market. I think that this inconsistency is largely explained by the fact that the old system, although becoming obsolete, is still strong enough, while the rudiments of a new pricing system are just beginning to emerge.

Thus, the Chinese supply futures contract for oil imported into the PRC, which was launched in March 2018, despite obvious successes in terms of the number of bidders (mainly Chinese retail investors), turnover and number of open positions, still could not become a real market benchmark for oil imports into China. International oil traders still prefer to watch events unfold from the sidelines, due to the complicated structure of the contract – including from the standpoint of its performance by physical delivery.

The experience of the Dubai Mercantile Exchange (a de facto CME subsidiary in the Middle East) is also noteworthy. The delivery contract for Omani oil reached good indicators in terms of the number of deals and bidders. Unlike actually non-deliverable futures for Brent (ICE) and WTI (CME), up to one third of these contracts are performed by physical delivery and the vast majority of this oil is shipped to China.

Market participants are already actively discussing a new Middle East initiative – the expected launch in the UAE of a new exchange with a deliverable contract for Abu Dhabi oil from the Murban field, with the participation of the ICE exchange.

The rapid growth of consumption in the East Asia are making it possible to consider the ESPO blend it delivers as another opportunity in formation of an independent price indicator for Russian oil

Separately, I would also like to draw the attention of readers to the various types of auctions that are held by a number of exchanges and trading platforms for physical volumes of crude. These include the DME auctions for Iraqi oil, CME auctions, as well as auctions for crude-oil storage facilities on the US coast, along with attempts to launch storage-capacity futures.

Even price agencies can’t ignore these new trends, which point to the increasing role of information on actually-concluded oil-market deals in world oil pricing. Thus, the Argus Media agency has just launched its own Argus Open Markets system to increase the transparency of crude oil deals in Europe. The system is called «pricing platform»; that said, heavy emphasis is placed on the fact that, although participants have the opportunity (and are motivated) to submit sale-purchase requests within the system, the platform is not an exchange.

According to the St. Petersburg International Mercantile Exchange (SPIMEX), these facts and events not only demonstrate pent-up demand for change on the global oil market, but also illustrate the main direction of change – namely, the course towards transparent electronic, auction and exchange mechanisms of price formation based on actual deals involving physical barrels. In all likelihood, the further development of these trends will lead to significant, and possibly fundamental, changes in the current oil-pricing system.

The Russian Exchange, in turn, is also consistently working in this direction, fully mirroring the aforementioned global trends. Although the launch of a deliverable contract for Urals crude in November 2016 hasn’t yet led to significant changes in the pricing of this very important grade of medium-sulfur oil, it has initiated a series of processes and discussions in the Russian petroleum industry and intensified our contacts with international oil traders, exchanges and price agencies, making us a rightful participant in the pricing changes unfolding in the global market.

Despite all of the difficulties, on the market for derivative financial instruments, whose core asset is various petrochemicals for delivery to the domestic market, the exchange is managing to achieve success. Thus, the gas-supply contract with a pricing point at the Allaguvat railway station, launched in 2018, as well as the similar LPG contract with a pricing point at the Surgut railway station, are actively traded on the market. Since the launch, trading turnover involving these instruments has amounted to 280 K tons, and supply volume – to over 108 K tons. We also began receiving requests from our customers, the largest Russian oil companies, to consider the possibility of launching similar tools at their bases. One of the important consequences of this is the formation inside oil companies of the necessary infrastructure for trading and risk management, which, in our opinion, will be used in the future for operations involving export flows of Russian oil.

As concerns the electronic procedures for selling oil, both to the domestic market and for export, the Exchange currently has significant successful experience in their implementation. Zarubezhneft and Rosneft Oil Company have long been using the exchange’s infrastructure to hold bidding under the sale of crude oil and petroleum products.

The bidding procedures continue to be improved. New software has been fine-tuned and is already being tested by several companies. At the same time, it’s important to note that our own internal work rules and the business processes of domestic oil companies will not change at this stage. The main goal is to make auctions more competitive for buyers, to create a mechanism for improving price compared to the current approach to their organization.

Market is discussing a new initiative – the expected launch in the UAE of a new exchange with a deliverable contract for Abu Dhabi oil from the Murban field

The start of oil sales through electronic procedures will provide an opportunity to concentrate on a single platform the traditional buyers of Russian oil and attract new ones, which in turn will create the necessary competitive pressure and provide the best sale conditions for domestic oil exporters.

It is important to note that most Russian oil companies already use bidding procedures in one form or another in their commercial activities, which creates good prerequisites for the success of the new exchange project.

In the future, on the basis of such bidding, a common market indicator of the value of Russian oil may appear, which could be used as the basis for the methodology for calculating the Urals oil price index which, in turn, would serve as the core asset of the Urals crude settlement futures contract.

SPIMEX expects that the implementation of its plans for the organization of export-oil auctions on the exchange’s electronic platform, formation of a price index and the launch of a settlement futures contract for Russian Urals crude will help solve the problem of creating a new pricing mechanism for Russian oil through direct-market pricing based on actual deals.

According to the assessment of SPIMEX experts, the Urals grade represents the exchange’s most promising direction for the formation of an independent price indicator for Russian export oil. At the same time, the rapid growth of consumption in the East and Southeast Asia, combined with the successful operation of the Eastern Siberia – Pacific Ocean pipeline, are making it possible to consider the ESPO blend it delivers as another opportunity in this area.

World practice shows that an exchange, as an infrastructure organization that forms spot and derivatives markets, supported by the use of modern exchange technologies, makes it possible to successfully address the problem of increasing the transparency of oil and petroleum-product pricing by creating mechanisms that stimulate competition among participants.

Therefore, today, one of the most important objectives of SPIMEX as the largest domestic commodity exchange is not only to increase the turnover of trading with spot goods (spot deals), but also to further develop, in partnership with the leading bidders – Russian oil companies, a full-fledged derivatives market that will make it possible to support the circulation of a wide range of liquid deliverable and settlement futures contracts.