Oleg ZHDANEEV

Head of the Center of Competences for Technological Development of the fuel and energy complex, FSBI REA (Federal State Budgetary Institution Russian Energy Agency); RF Ministry of Energy, Cand. Sc. Physics and Mathematics

e-mail: Zhdaneev@rosenergo.gov.ru

Introduction

The percentage of the defense industrial complex in the Russian economy makes about 5–6 % of the country industrial production and 3 % of its GDP (gross domestic product) [1]. Meanwhile, at the moment this is the only sector of processing industry in Russia, where the domestic companies have the final market under their full control. About 70 % of all Russian high technology products is made in this sector [1].

In 2015 the volume of non-defense products (hereinafter – NDP) output by the defense industrial complex made 15.9 % reducing by twice since 2011 [2]. In 2016, the percentage of civil products in the output of the defense industrial complex,

which was assigned with the goal for diversification of production, for the first time in years has shown the growth increasing up to 18.6 % mainly due to the aviation industry, where the state has implemented significant number of different state aid measures.

In 2019, the percentage of civil products in the defense industrial complex reached 22 % or almost 170 bln rubles,where the domestic machinery and equipment makes only 25 %. At that, in 2019, according to FZ-44 and FZ-233, the capacity of the home marketplace made correspondingly 8.6 trln and 23.5 trln rubles [3].

Link: forums.airbase.ru

According to the Ministry of Industry and Trade of Russia, by the end of 2020, the percentage of civil products of the defense industrial complex reached 24 % [4]. A number of companies came to the level of 30 % and above. But the grows is going mainly due to the defense industrial complex subsidiaries old-established in the open market.

Nowadays, the Russian fuel and energy complex is one of the main customers and participants of the domestic industry. In 2020, the market for oilfield services under market conditions is valued at 1.6 trln rubles [5], at that, in 2019, the demand for equipment on the side of the fuel and energy complex made 1.3 trln rbl, including:

• oil&gas equipment – 894 bln rbl;

• equipment for coal-mining industry – 115 bln rbl;

• equipment ford electrical energy complex – 316 bln rbl.

It is worth noting that along with development of conventional technologies of the fuel and energy complex, the renewable energy production industry, including the hydrogen one is developing actively at present. Till 2035, only in Russia, it is planned to commission above 10 GW of installed capacity for power generating facilities operating based on solar and wind power [6]. The hydrogen will be used as the fuel for transport, for energy supply to independent and isolated industrial facilities, including the fuel and energy complex. According to forecasts, the global demand for hydrogen will grow from 0.46 to 7.92 mln tons over the next 10 years [7].

The processing and production capacities of the defense industry have been modernized actively over the last decade. However, due to gradual reduction of the defense order they appeared to be unloaded and can be used for production of the equipment and the components in demand in the whole world: the electric energy storage systems, including the rechargeable batteries and the fuel cells, megawatt capacity wind power generating plants based on floating platforms for the Arctic conditions, photovoltaic modules, independent energy generating plants based on hydrogen fuel, technologies for disposal of the rechargeable batteries, composite blades for wind power generating plants and a lot more.

During XX century Russia and a number of other countries of the world have experienced diversification of the defense industrial complex a few times. Quite often in the world practice the country defense industrial complex is used for satisfying the needs of the non-defense industries.

Japan

The Japanese producers of weapons are not present in the global market practically as opposed to high technology and high quality civil products spread all around the world. After the second world war the Japanese government has taken the responsible and systematic course fort transfer of technologies based on the license agreements and other methods for transfer and acquisition, which the country will need for creating independent defense industrial complex – kokusanka [8]. Thus, nowadays, the local Japanese industry produces all warships and submarines of the country, although they are equipped with American Aegis weapons system. Up until recently, the contrast between the non-military and defense technologies was a result of the Japanese government prohibition on the export of weapons introduced in 1967 and partially canceled during Shinzo Abe government [9].

Japanese Largest Defense Industrial Corporations: Mitsubishi Heavy Industry, Kawasaki Heavy Industries, Mitsubishi EIectric Corporation, NEC Corporation or Ishikawajima- Harima Heavy Industries Corporation. All of them are the outside players in the world of defense industrial complex, but, on a total return, these companies are equal to such largest world corporations as Boeing (USA), Raytheon (USA) or BAE Systems (Great Britain). Thus NEC company (Japan) taking the 59-th place in the world earnings from the defense industry, has earned almost the same amount as Lockheed- Martin, the largest defense industry firm in the world [10]. production of military weapons in Japan is made at the private non-defense companies’ enterprises exclusively. The primary contractors of the Japanese Defense Agency are 9 the most large private companies. They use cooperation ties widely issuing contracts for production of the most important machinery equipment units by different dedicated companies, which, in their turn, use a few hundreds of smaller subcontractors as well [11].

At the end of 50s of XX century the Japanese government held a course for aiming 80 % of industry, including the defense industrial complex to the output of high technology products together with initial wide expansion to international non-military industrial markets. At that, the MIC (military-industrial complex) has been gradually transferred to the private sector of the economy almost completely. During the last 20 years, the Japanese defense companies have completely satisfied the demand for the defense products inside the country; they are also present in the international weapons markets, but, at that, the incomes of enterprises from the high technology civil products make 80–90 % at average.

Israel

During the first years of its existence Israel developed the equipment and technologies for defense industrial complex inside the state research institutions. The attempts for transferring the developments to the non-military are were taken, but they have not accepted the major distribution.

In 1968, inside the Ministry for Industry and Trade there was established the Senior Scholar Department with the main goal of which was the target financing of research&development forks (hereinafter – R&D works) of the private companies, including the area of the fuel and energy complex. At the domestic level, it was defined that the promotion of research and development must occur with no immediate intervention on the side of the state in the scientific process. In 1985 there was adopted the law on the program for support of industrial.

At that moment, the R&D works with wide spread attraction of highly qualified scientific and technological specialists from ex-USSR countries, the low on “technological incubators” was adopted. This law assisted to diversification of the state segment of the defense industrial complex. The state started to provide the active policy for creation and financing, including for account of venture investment system, for example, Yozma, established public subdivisions or subsidiary structures of the defense industrial complex companies operating on non-military R&D works.

At the moment, the role of the state in the Israeli system for transfer of technologies is quite large. The major role play the Ministry of Defense and the Ministry for Industry and Trade. The senior Scholar office is responsible for all innovation policy with distribution to the relative areas. the part of the public funds is distributed on a competitive basis, but there are selections with no tendering. All the applicants for R&D works shall obligatorily have the business partner: 10 % invests the enterprise, 90 % –the public foundation [12].

The Israel expenses for research make 4.5 % of the general national product, as a result, 11 % of Israel GNP are high-tech products, and over half of 70 bln dollars accounts for high technology goods. At that, the country takes the 4-th place in the world on weapons export [13].

For application in Russia, it is specifically worth noting the Israeli wide-scale experience in venture and batch financing of R&D works both in the defense industrial complex and in the non-military industry [14].

USA

Upon the second world war completion, the USA have proceeded to the defense industry diversification. Diversification have been conducted under the impact of the market factors combined with the governmental policy of promoting the personal investment holdings by means of taxing and other instruments. The state has also financed specific programs, for example, on vocational training and personnel retraining.

In 1963, there was adopted the law, according to which the firms capable to produce weapons and military equipment were provided with the orders within the limits of at least 30 % of the products produced by them.

In the 80-th, there was provided the state support of the enterprises performing diversification on market extension of civil products and there was ensured access to credits on preferential terms. The access of the military department to the non-military industry of economy was provided [15].

In the course of integrated research it was found that the, companies or divisions of enterprises occupied in the defense industrial complex require above five years for highly risky reconstruction of their enterprises for output of the civil products in the free market conditions. At the start of 90s the part of enterprises of the defense industrial complex selected the strategy of selling the par or the whole company business operating for the defense industrial complex to the larger commercial corporations,

Thus, the companies Lockheed Martin Corporation and the Boeing Company, absorbing the companies of the defense industrial complex Martin Marietta and McDonnell Douglas have appeared in the current state.

The key effective features of the USA defense industrial complex diversification in different periods applicable in Russia at the moment [16]:

• in accordance with Stevenson-Wilder Act, in all federal research institutes, design bureaus and department structures there were formed special divisions in the form of departments providing transfer of science and technology results obtained in the defense area into non-military production;

• Protection and using of the experience accumulated in the defense industry for more than 50-year period of its existence with development of the directive set of criteria determining possibilities for defense industry sector being the deadline for supporting the country defense capability and having no analogs in the non-military area;

• conducting of combined inter-institutional audits for determining the enterprise production capabilities, which are not subject to re-orientation;

• performing of studies in the area of marketing and promoting of new products to the world market at the level of the executive state government bodies.

China

Deng Xiaoping’s reforms at the end of 70s of XX century assumed significant integration of the military and civilian sectors and active use of the defense industrial complex enterprises for output of civil products. In 1990, the China’s People’s Liberation Army (hereinafter– CPLA)business activity has annually provided up 2 % of the China GDP, the China Army controlled almost 20 thousand of business enterprises – up to 50 % of the ground troops personnel, i.e. above 1 mln people. The army factories manufactured up to 70 % of civil products. By the beginning of XXI century, the Chinese senior management has come to conclusion that the active business

activity inside the CPLA started to hinder the growth of its combat effectiveness.

In 1998, the CC of CPC (the Communist Party of China) has taken a decision on termination of all forms of CPLA business activities.

The key measures of promoting the productions can be attributed to:

• reorganization of the defense industry complex through creating of 11state industrial corporations in separate industries for output of military and civil products, including for export;

• creation of dedicated, manufacturing areas aimed for export;

• VAT favourable terms;

• preferential export financing by the public development banks and through government guarantees;

• there were excluded from secret work and reviewed above one hundred legislative acts on the defense industry.

By 2002, the percentage of the civilian goods in the total gross output of the Chinese defense enterprises reached 80 % in conjunction with the defense industry conversion into profitable industry [17].

In 2003, the Committee for control and management of the state-owned property was established in the structure of PRC State Council (People’s Republic of China), representing the state as the owner of all government-owned corporations, including the military and industrial ones. The Committee was able to increase the efficiency of corporations due to coordination of systematization and formation of modern science and technology base for military production based on integration of the defense industrial complex and advanced non-military technologies of the technology companies, including the private and the foreign ones [18].

Link: unmannedsystemstechnology.com

In 2013, the enterprises of the defense industrial complex were allowed for performing additional issue of shares and selling them at the stock exchange, thus attracting the private capital in the defense industry area with no sacrificing the state control of the controlling interest. This solution is promising for application in Russia. But in parallel, there also exist the counter examples (Hong Hua group of companies for production of oil&gas equipment, etc.), when the corporations of the Chinese defense industrial complex invested in the private business staying in distressed financial situation:obtained the controlling interest, but, at that, have hardly interfered in management.

Interaction Schemes

For diversification of the defense industrial complex and for needs of the fuel and energy complex in Russia, it is necessary to solve a number of tasks, including provision of the defense enterprises with information on the aggregated demand and industry-based technical requirements. It is also required to define applicability of the defense enterprises competence for development of equipment and technologies for defense industrial complex and economic feasibility for reconstruction of each defense enterprise for needs of the fuel and energy complex, organization of personnel training with competences in the fuel and energy complex operation.

In the oil&gas industry, for the main consumer of equipment in the fuel and energy complex, there were highlighted ten critical areas for import substitution and technological development for application of the workforce and means of the defense industrial complex enterprises:

- Development and production of the equipment for exploration on land and in sea, including seismic exploration equipment.

- Highly-automated drilling complexes for land application with cargo carrying capacity from 225 t to 750 t.

- Equipment system for hydrofracturing of oil and gas formations.

- Ice-resistant mobile rig for exploratory drilling in the Arctic in the Far East.

- Development of equipment for subsea production of oil and gas.

- Different complexity hydraulic systems, including the whole series of components such as high pressure hydraulic pumps, hydraulic manifolds, three and four section cylinders, quick-release connections, valves, magnet units, control systems.

- Explosion-proof equipment for oil&gas industry.

- Development and production of blowout prevention equipment for land and sea application.

- Production of microprocessor units, key components of the process control automated system, information digital transmission systems.

- Equipment for LNG middle and large-scale production.

The current scheme for interaction of the large enterprise of the defense industrial complex and the fuel and energy complex company has been drawn up for description of existing production relations between the defense industrial complex and the fuel and energy complex under any project implementation within the framework of the specified ten areas. The project production, economic, research and design process operations were described starting for appearing technical or technological request from the company of the fuel and energy complex or the design idea from the enterprise of the defense industrial complex prior to creation of the production sample.

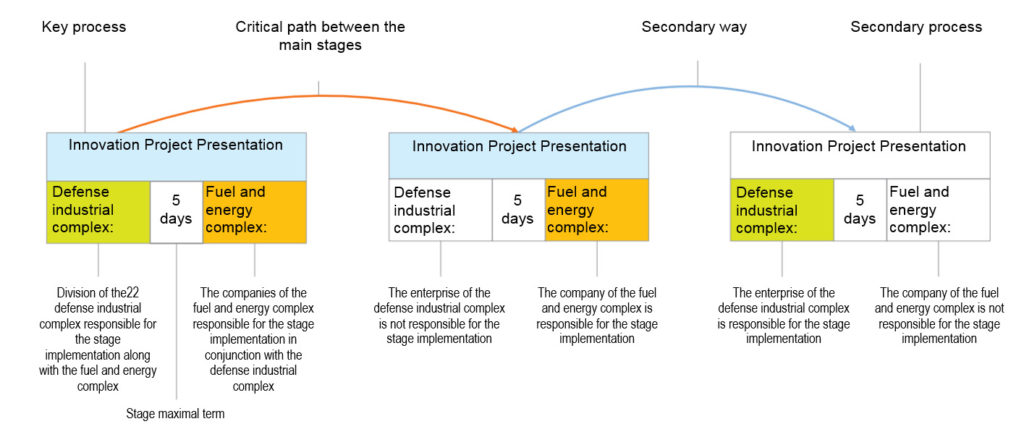

The main parameters specified for each stage of the developed scheme are given in Fig. 1. On the whole path of the project implementation, the scheme highlights the key processes for calculating the critical way and the secondary stages passing in parallel.

The key and secondary processes were divided by 5 enlarged stages: goal setting, architectural solution, R&D works, production and field tests/output for serial production. The total duration of the critical path by all stages of the current interaction scheme made more than 50 months.

Stage No. 1. Goal Setting

Stage No. 1. Goal Setting

At the stage of goal setting, for defining the uniform technological policy on development, expansion of production for the area of the fuel and energy complex, including attraction of state funding, it is important to have the plan of the fuel and energy complex industry-based needs for the fuel and energy complex enterprises of the defense industrial complex. The industry-based information includes the data on demand for equipment and technologies, the services both for a year and the medium-term horizon up to three-five years.

Creation of the national engineering company under the authority of the Ministry of Russia with provision using budget funds and banks operating in the defense industrial complex can resolve an issue of industry-based needs.

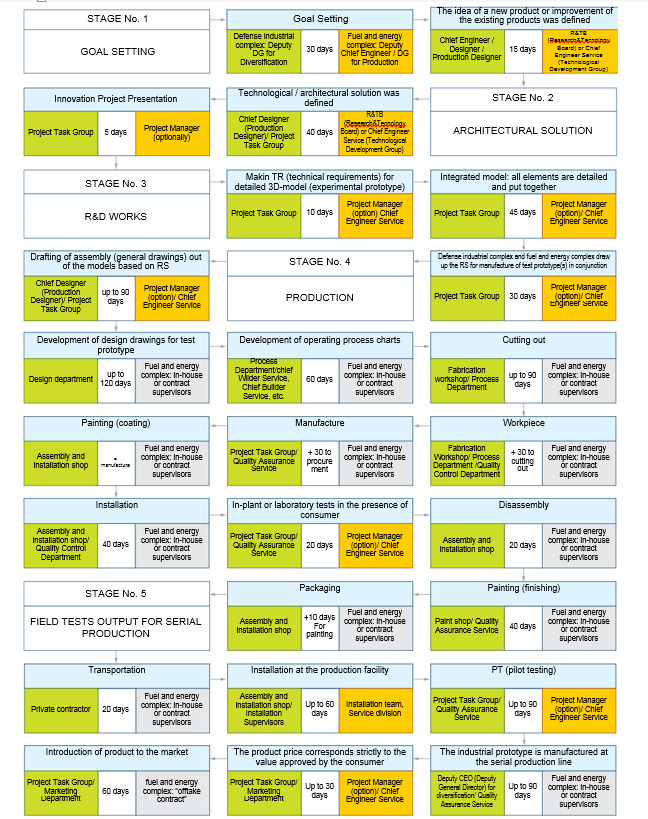

The target scheme based on analysis of the current scheme prepared by the representatives of the defense industrial complex and the fuel and energy complex is given in Fig. 2.

91 process was analyzed in the final target scheme.

1. Goal setting – 5 processes.

2. Development of architectural solution– 9 processes.

3. R&D works – 25 processes.

4. Production – 28 processes.

5. Field tests. Output for serial production. – 24 processes.

The final critical path in the target scheme can be reduced to 36 months.

The companies will include operation of the fuel and energy complex with basic science, immediate development of technologies and equipment in the form of preparing the industry-based requirement specifications (hereinafter – RS) and test procedures, development of the projects technical and economic feasibility, conducting of technical audits for projects and enterprises.

This initiative will allow for forming the technical program on development, expansion of production for defense industrial complex companies in the area of the fuel and energy complex with synchronization of industry-based investment strategies for five year period based on the volumes of machinery equipment procurement, the volumes of the services and costs for R&D works. At that, the minimal need for industrial requirement specifications for equipment, technologies and service is estimated at 5000 units in a period of five years.

It is important that the results of engineering company operation can be accessed by all consumers of the fuel and energy complex on an equal basis. The process of performing independent audit of the defense industrial complex enterprises, if required, with involving the customers’ companies specialists for the purpose of defining competences and prospects for diversification of production for the fuel and energy complex will include the following stages:

• definition of production capacities applied for fuel and energy complex;

• necessity for building-up the production infrastructure;

• definition of characteristics for production sites and infrastructure;

• assessment of human resource potential (necessity for re-training, personnel recruitment);

• assessment of necessity for advanced training of the quality assurance service;

• determination of R&D work development level;

• necessity for changing organizational structure for needs of the fuel and energy complex;

• definition of practical capabilities for cooperation with private companies operating in the fuel and energy complex;

• pricing mechanism at the enterprises, etc.

The semi-submersible transport ice-resistant vessel with minimal cargo carrying capacity of 50 thu tons, the hull ice-class Arc 7 can become an example of a great mutually beneficial promising project for setting the goals to the fuel and energy complex for defense industrial complex for Russian oil&gas market, logistics in the Arctic and entrance to the global market of large-block transport shipment [19]. The consumers on the oil&and gas industry may potentially be all Russian companies operating or leasing the offshore drilling platforms and implementing LNG projects in the Arctic. The vessel of this class will be interesting for the Ministry of Defense for provision of large tonnage logistics in the RF Arctic region for military goals, as well as for the companies responsible for infrastructural development of the Northern Sea Route for the purposes of creating the mobile bases of operation. Sovkomflot or Arktimorneftegazrazvedka may become the operator from the fuel and energy complex. The defense industrial complex enterprises in cooperation with the private developers can perform R&D works, provide the project integrated management and further service: The United Shipbuilding Corporation (CDB Korall, etc.), the private companies for driver control systems (for example, LLC NTC Privodnaya Tekhnika), etc.

Stage No. 2. Architectural solution

As a result of analysis of the current scheme of the defense industrial complex and the fuel and energy complex interaction starting from the stage of architectural solution development and at all further stages, it was defined that the project for creation of a serial product attracted more than 10 different departments, services and enterprises, at that, several independent directors are responsible for stages of work, which slows down the project implementation term significantly. At the second stage, during elaboration of architectural solution on the project, this problem becomes already quite serious for compliance with the total time limit of work performance.

It is possible to solve it using the solution verified by the international practice – the method of conducting the project activity by the multi industry corporations. The essence of this proposal consists in creating inside each industrial enterprise of the defense complex a group of technical technological development or the group on management of the projects with well-defined goals and set of functions for three year period.

The Group immediate manager is the Deputy General Director for Diversification. His appearance is required at the most of defense enterprises. At the moment this position is introduced only in 17 % of organizations [20]. The group personnel is selected based on the project specificity. For example, the minimum composition of the group for creation of technological complexes for oil&gas industry should include the following subject matter specialists:

• Power Engineer and/or Electronics Engineer for CPCS (computerized process control system) of the fuel and energy complex;

• Mechanic Engineer and/or Building Engineer from the fuel and energy complex;

• Specialist on procurements and/or provision/logistics;

• Subject-matter Engineer by the industrial area of development;

• Production Designer and/or Enterprise Designer and/or Planning Analyst.

The companies of the fuel and energy complex have possibility to provide only high level technical requirements with no detailed description and the sketches often using the specific terminology understandable only for the fuel and energy complex specialists. The requirement specifications in the fuel and energy complex is prepared by the performing company based on the technical requirements from the customer, approved by the customer and attached to the contract for research and development works, production of the test prototype and serial procurement. Consequently, during the Group formation it makes sense to organize the limited temporary or continuous rotation of production, design, economic and legal staffs between the defense industrial complex enterprise and the partner-companies of the fuel and energy complex.

On the whole, the group managerial and coordination goals traditionally include searching for projects, communication with the fuel and energy complex consumers and federal agencies of executive authority, business plan development with definition of pricing, agreement of technical requirements and preparation of design and operational documents in conjunction with consumers. Its work covers the issues of cooperation with the enterprises during implementation of integrated, technically rich projects, high-level organization of production preparation, performance of thein-plant and field tests and putting into production.

Stage No. 3. Research and Development Works

All processes of R&D stage are not applied to all and every projects to full extent. Thus, with available solutions and full complete set of design and operational documents (hereinafter – DOD), provided by the customer, the defense industrial complex enterprise is just required to adapt the detailed,shop drawings to their technological tooling and proceed with out of products. Many enterprises of the defense industrial complex are aimed at creating the whole complete set of design documents inside its facilities, which leads to increase of the permanent staff, used skilled professionals (designers, production designers) and growth of costs for license of software for designing, correspondingly. The price of the annual license for software in the machine-building industry for one personal computer can reach 1–2 mln rubles per annum not counting the value of the equipment and the workplace arrangement.

For majority of energy projects, it is advisable that the enterprises of the defense industrial complex have 1–3 designers on the staff for creating the detailed 3D-model of the product according to the customer technical requirements and approving of RS for project/product.

At the moment, there is no well-functioning mechanism for transfer of intellectual activity results owned by the Ministry of Defense to the civil industry. The existing non-public military inventions on production technologies can have great significance in the terms of developing architectural solution and the documents on the project.

In terms of organization, the divisions for innovation development are not at all enterprises of the defense industrial complex. The system of the defense industrial complex is built in such way that the R&D works are preferably performed on the account of specialized institutes. This is completely

fulfilled economically within the framework of the State Defense Order (hereinafter – SDO). In the markets of civil products, with a great number customers with different requirements, this model of scientific activities is hardly suitable for use. For changing the model at the defense industrial complex enterprises, it is possible to create the strategy for development of intellectual property for the purpose of transfer of exclusive rights for the results of this activity to the Russian Federation resident via the joint ventures of the defense industrial complex and the fuel and energy complex companies, including under the terms of royalty-free and open licenses.

In the course of R&D works stage, in parallel with passing the key processes, the defense industrial complex enterprise needs to completely define the pricing policy on the developed technology or machinery equipment and form the business model. Here, it is worth noting that during work on SDO (State Defense Order) the defense enterprises allow for 20 % level of profitability for their own production and 1 % for purchased elements. For civil products in the fuel and energy complex, such division is not applicable – it is economically feasible to give advantage to cooperation interaction.

Stage No. 4. Production

For production stage, creation of the business unit, dedicated organizational structure, where a few areas, which do not attribute to the are the critical organizational solution at the enterprises of the defense industrial complex core activities [21] can become the critical organizational solution at the enterprises of the defense industrial complex. The business unit can be formed by means of creating the subsidiary organization based on the external partner attraction from the civil market under the terms outsourcing or via organization of the joint venture. At that, for it is possible to allow the private companies for joining the joint venture from own funds preliminary estimated by RID (Russian Institute of Directors).

The business unit implies organization of work of the financial accounting service, planning and estimating department,economic department independent of the enterprise main services for distinguishing pricing and overhead costs of the whole production for SDO needs and production of civil products. This will allow for significant reducing the terms for implementation of projects and the level of the included overhead costs at the enterprises of the defense industrial complex down to 100 % in terms of SDO and to maximum level in the civil industry by 40 %.

The long-term funding of the civil independent divisions of the defense industrial complex enterprises can provide the new forms of contracting between the enterprises of the defense industrial complex and fuel and energy complex companies with state participation: “offtake contract” the contract with deferred demand. At that, the state can ensure the guarantee of obligations for the defense industrial complex enterprises during the first 3–5 years.

The advantage of concluding such type of contract with the fuel and energy complex companies with the state participation is advisable to give to the joint venture companies of the defense industrial complex and to the private servicing and production organizations. The “Offtake contract” for the period of 3–4 years will allow the companies of the defense industrial complex for ensuring the process of the equipment/ technology creation from the idea to the output of the serial prototype under more loyal banking terms and conditions. The good example of the contract with deferred demand can be the contract between Gazprom and the Aerospace Defense Group Corporation Almaz Antey for creation of 2 complete sets of the subsea production unit for 5 bln rbl.

Link: vpk-news.ru

The issue of quality assurance are also of great significance in the defense industrial complex interaction with the fuel and energy complex, and it is the goal integrated analysis and implementation of standards regulating operation and production of products for the fuel and energy complex. For example, individual determination of welding procedures standards from AWS D1.1/D1.1M:2010 to DDD 51–31323949–38–98 (Detailed Design Documents) for each project and the need for relative retraining of welders for each procedure, development of the plan for performance of works by cranes during equipment assembly in the field by the company efforts, etc. For the defense facilities, it is possible to solve this goal quickly and efficiently only by cooperation with the private companies operating in the fuel and energy complex market. For high-quality development and enhancement of the existing quality assurance units at the defense industrial complex enterprises, the divisions of the military representative office systems can be used with their relative retraining.

At the moment, on request of ordering bodies of military administration, the Military Representative Office of Ministry of Defense of the Russian Federation can make assessment of the produced products conformance in the for of quality control with subsequent documentary evidence of the conformance evaluation (acceptance) under contracts not connected with fulfilling the state defense order for the needs of the Ministry of Defense of Russia. In this case, the Ministry of Defense receives 1% of the contract total value from the industry organization. Within the framework of diversification, it is assumed to develop the measure for support the defense industrial complex enterprises, when the work of the military representatives for the purposes of civil projects was compensated by subsequent taxes from selling the produced products.

Stage No. 5. Field tests. Output for serial production

Testing of machinery equipment and technologies by the industry companies is one of the most labor-consuming and durational as per deadlines for implementation of the goals at the project final stage. Not infrequently, the testing procedure has to be repeated many times in different companies due to absence of mutual recognition procedure. This goal n be solved, including for equipment developed and produced by the companies of the defense industrial complex through the following operations:

- Creation and approval of the industry-based test procedure.

- Organization of test centers and fields.

- Inter-departmental commission acceptance of equipment and technologies.

- Certification recognized at all business entities in Russia and abroad.

The engineering company, where it is possible to organize provision of the customer acceptance testing according to the early industry test procedures can take the role of the test center. This will allow for ensuring the conformance of all companies-producers with all requirements of the industry-based requirement specifications under maximum possible production localization.

Obtaining positive expert evaluation from the recognized test center will dispose the consumers of the need for performing the repeated tests. At that, certification center of the ANCO Institute of Oil&Gas technological Initiatives (Autonomous Non-Commercial Organization) [22] can become the guarantee of certification authenticity..

Within the framework of this publication, the divisions of the defense industrial complex can take part in creation of independent sites for test fields divided by the types of technologies and equipment. For example, the field for testing the well equipment: the bore bits, the rotary guided systems, the drill pipes, the casing hardware, etc.

The defense industrial complex has already had the experience in implementing the goals specified in the RF Government Decree No. 546 of April 30, 2019 “On accreditation of certification bodies and test laboratories (centers) performing operations on assessment (verification) of conformance in relation to the defense products (works, services) supplied under the state defense order, and on making amendments separate laws of the Russian Federation Government” [23].

It is important not only to develop the domestic products for technological independence of the fuel and energy complex of Russia, but also ensure their preferences during procurements subject to conformity with quality, price and delivery terms. For this, it is possible to update the RF Government Decree No. 925 of September 16, 2016 “On priority of Russian origin goods, works and services, performed by the Russian persons in relation to the goods of foreign state origin, works and services performed by the foreign persons”.

Also, according to FZ No. 233 and FZ No. 44, at the stage of bidding procedures in the companies with state participation, for increase of purchase share of the domestic equipment and servicing services in the fuel and energy complex, it is recommended to consider possibility for making amendments in the recently adopted RF Government Decree No. 2013 of 03.12.2020 and. and RF Government Decree No. 2014 of 03.12.2020: extend the list of OKPD2 (All-Russian classifier of products by type of economic activity) on equipment for the fuel and energy complex and add OKVED (Russian National Classifier of Types of Economic Activity) on provision of servicing services in the fuel and energy complex.

Conclusion

The challenging goals face the Russian fuel and energy complex on support of the oil and the gas condensate production volumes at the level at least 490 mln tons by 2035, on reaching the LNG production volume at least 80 mln tons, reduction of the average interruption duration index value in the electrical power supply system down to 2.23 hours, development of new industries, including the hydrogen energy production industry, and other ones. At the same time, the defense industrial complex was set the goals within the framework of the Russian Federation President instruction on reaching the output level of the civil products by 30 % in the total volume of the defense industrial complex production by 2025 an at least 50 % by 2030. Moreover, on account of the state defense order reduction by 5 % in 2023 [24], there is the risk of reducing the part of the qualified specialists involved in the defense industry by more that 2 mln people. At the same time, defense industrial complex has design and production opportunities on developing high-tech domestic solutions By 2025 it may take 25 % of the market of the equipment for the fuel and energy complex, which, in current prices, makes more than 300 bln rubles.

For reaching the target indicators of the defense industrial complex interaction with the fuel and energy complex, arrangement of staff rotation is feasible between the enterprises of the defense industrial complex and the fuel and energy complex for forming up cooperation and provision of understanding industry-based features of the equipment operation, requirements to servicing and the terms of fulfilling the orders. Creation of engineering company for ensuring efficient coupling of industries, including for solution of goals for preparation of industry-based requirement specifications sought-after products and technologies in the fuel and energy complex, industry-based test procedures, engineering supervision and provision of continuously operating inter-agency commission acceptance will allow for reducing the terms for developing the new equipment units, ensuring proper quality and highly competitive value.