Evgeny TYRTOV

Senior Consultant VYGON Consulting

e-mail: tyrtov@vygon.consulting

Elizaveta DEMIDOVA

Аnalyst VYGON Consulting

e-mail: tyrtov@vygon.consulting

Modernization of domestic refineries will increase the production of light oil products, most of which will be exported. Herewith, several negative trends are growing at once in the key foreign market for us – in Europe – which in the near future may seriously affect the sales and economy of Russian oil refining. This is a climate agenda that limits the demand for oil and petroleum products, as well as increased competition due to the commissioning of additional processing facilities in the Middle East. To protect its own import niche in the European market, the state needs to maintain support for Russian oil refining, and companies need to develop production flexibility and increase the technological level of refineries.

Industry modernization

In the Russian oil refining industry, large-scale modernization of existing facilities continues, which is performed within the framework of quadripartite agreements signed in 2011 by oil companies, FAS Russia, Rostekhnadzor and Rosstandart, as well as modernization agreements concluded in 2019 between the Ministry of Energy and companies. According to the agreements, the owners of the enterprises undertook obligations to build 98 secondary oil refining units and to reconstruct 36 ones by 2027. Among them are installations for both refining (reforming, isomerization, hydrotreating, etc.) and deepening (hydrocracking, catalytic cracking, visbreaking, delayed coking) processes. Actual volumes of investments under these agreements in 2011–2019 exceeded 1.4 RUR trln, and of 134 projects, 86 have already been implemented [1].

Also in 2021, a new mechanism for stimulating the modernization of oil refining facilities was launched – an investment premium, which is a subsidy paid in the event of the commissioning of additional secondary oil refining units. The main goal of the new instrument is to attract additional investment in the modernization of oil refining facilities. Within the framework of the investment agreements signed between the Ministry of Energy of Russia and the companies, it is planned to commission 30 new installations with a total investment of about 0.8 trln RUR.

Among the oil refineries that signed the agreement are the Omsk Refinery, Moscow Refinery, Tuapse Refinery, TANECO, Gazprom neftekhim Salavat, Nizhegorodnefteorgsintez, Afipsky Refinery, Orsknefteorgsintez and others [2].

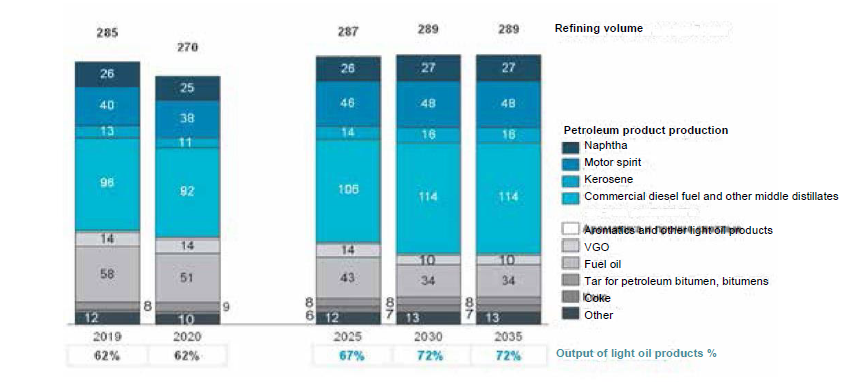

The modernization should result in a decrease in the share of simple refineries (that is, those that do not include deepening process units), an increase in the capacity of more complex comprehensive refineries, and an increase in the yield of light oil products. It should be recalled that before the start of the modernization program in 2011, the technological level of the industry’s enterprises remained at a fairly low level. For example, the yield of light oil products on average in the industry was only about 56% [3]. After the commissioning of all the planned installations, on average in the industry, the share of light oil products yield will grow from the current 62% to 72% in 2030–2035. Thus, by the end of the current stage of modernization, domestic oil refining will reach the same level as European refineries.

The main part of the deepening processes planned for commissioning is aimed at the production of middle distillates, first of all, diesel fuel. In case of the implementation of all plans announced in the agreements, the volume of production of middle distillates will increase by 18 mln t or 19% compared to the level of 2019 (due to the COVID-19 pandemic and the decline in production caused by it, 2020 cannot be considered representative). The production of gasoline will also increase by 8 mln t, kerosene – by 3 mln t (Fig. 1). The production of heavy fractions will decrease due to the deepening of processing, the most significant drop will fall on fuel oil – from 58 to 34 mln t, i.e. 41%.

Export Markets: Reduced Demand Amid Increased Supply

Oil refining volumes in Russia today significantly exceed domestic needs. In terms of primary processing capacity and production of petroleum products (6.7 and 5.8 mln bbls/day, respectively), the country ranks third, being behind only China and the USA. Herewith, in terms of consumption, Russia is in sixth place with 3.3 mln bbls/day. [4]. In other words, about half of the oil products produced in the Russian Federation are exported. This situation is not unique: in some small producer countries, e.g. the Netherlands, Kuwait, Greece, Belarus, processing volumes also exceed domestic needs and surplus products are exported. However, among the 10 largest producers, Russia is the only major exporter of oil products, in other countries the oil refining industry covers only domestic needs, and some of the oil products are generally imported.

Source: author’s calculations

Thus, the domestic oil refining industry today largely depends on the export of oil products. Therefore, the reliability of foreign sales markets is an important factor in its stability.

The key sales market for Russian oil products is Europe, which today accounts for about 50% of all volumes of their Russian exports [5, 6]. The basis is made up of middle distillates (including diesel fuel), which account for more than a third of all supplies. These volumes currently account for almost half of the total imports of middle distillates to Europe. In general, Russia has been a key supplier of motor fuels to European countries for more than 20 years, significantly outstripping both the United States and the Middle East in market share [7].

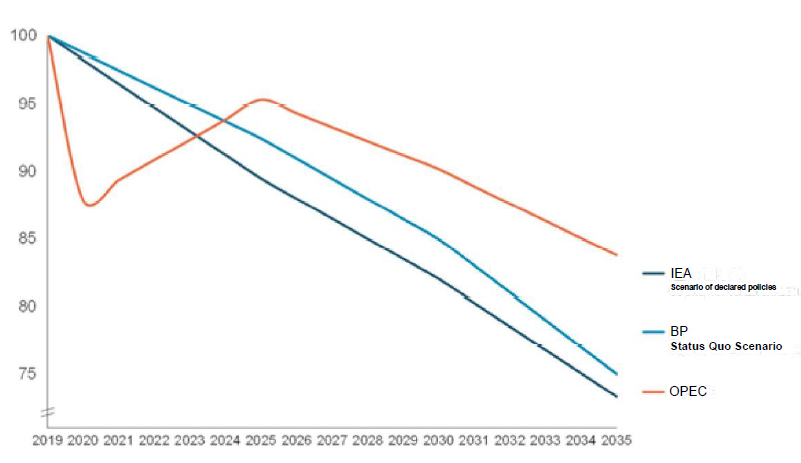

However, according to even the most conservative forecasts of the IEA (Scenario of declared policies) and BP (Status Quo Scenario), oil and oil products consumption in Europe will decline and will never return to the maximum level recorded in 2019.

an increase in the share of electric and natural gas vehicles [11]. Indeed, European countries are now actively pursuing initiatives to reduce the transport CO2 emissions. For example, in Norway, as early as 2025, a ban on the registration of passenger cars with internal combustion engines will come into force. Similar bans will be introduced by 2030 in Sweden, Germany, Great Britain, Denmark. At the moment, already 31 countries at the federal and/or regional level have announced the potential introduction of a ban on the purchase of cars on gasoline and diesel fuel [12].

Source: [8, 9, 10]

The same forecasts are given by the Organization of the Petroleum Exporting Countries (OPEC) in its only scenario, which is also the most optimistic, expecting a decrease in oil consumption in Europe by 2035 by 16% from the level of 2019 (Fig. 2).

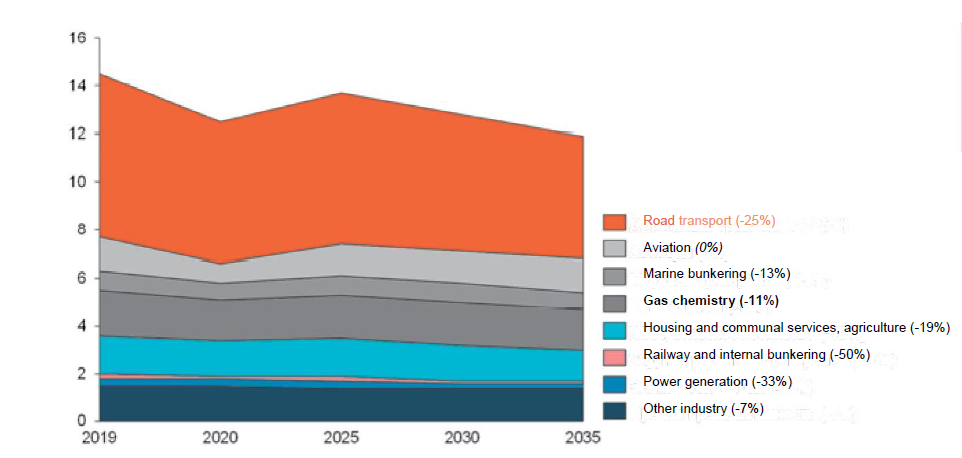

According to the OPEC forecast, the largest decrease will fall on the road transport segment, where demand will decrease by 0.5 mln bbls/day by 2025. or 7%, and by 2035 – by 1.7 mln bbls/day or 25% of the 2019 level (Fig. 3). The decrease in consumption in this segment is due to the increase in the efficiency of vehicles, According to the targets of the EU Renewable Energy Directive, the share of final energy consumption in the transport sector should be 14% by 2030, and the share of advanced biofuels should be at least 3.5% [13].

A similar situation is expected in other segments of the consumption of petroleum products in Europe. The decline in demand by 2035 in petrochemicals will amount to 11%, offshore bunkering – 13%, power generation – 33%, and in railway transport and domestic bunkering – 50%. The only segment where fuel demand is not expected to decrease is air transport.

Sources: [8], author’s calculations

The absence of commercially attractive alternatives to jet fuel will keep demand for it in the long term.

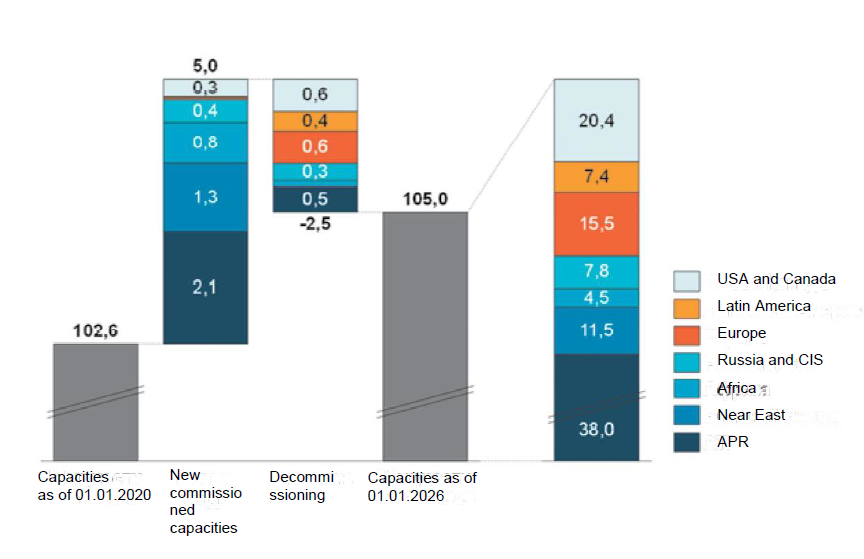

Against the backdrop of reduced demand in Europe, supply from refineries in the Middle East will grow. Today they provide 65% of all kerosene imports to Europe [7]. In the next 5 years, large-scale commissioning of new capacities is expected here, also focused on the markets of Europe and Africa. The growth in the primary sector will amount to 1.3 mln bbls/day or almost 13% of the current capacity (Fig. 4). We are talking about the launch of the Al Zour plant with a capacity of 0.6 mln bbls/day in Kuwait, which will become the largest refinery in the Middle East, as well as the Jizan project (0.4 mln bbls/day) in the Saudi Arabia. The commissioning of only these two refineries will instantly increase the refining capacity in the Middle East by 10%. With the launch of these industries, the countries of the Middle East are likely to try to occupy new import niches in Europe, including for diesel fuel.

Also, significant commissioning of new refining capacities is expected in the Asia-Pacific Region (APR), in particular China and India, which is associated with growing domestic markets. An increase in the volume of domestic refining is also predicted in Africa, where they are trying to reduce dependence on imports of fuel from the Middle East and Europe [11].

Herewith, due to the low margin of oil refining and the negative impact of the pandemic on market demand in Europe, it is planned to close inefficient refineries with a total volume of up to 0.6 mln bbls/day in 2020–2025 [8, 11], which is about 4% of the operating capacities. Among them are refineries in France and Spain.

After 2025, the trend for an increase in global refining volumes is expected to continue, but in smaller volumes. In 2025–2030, commissioning of new capacities will amount to 3.7 mln bbls/day, and in 2030–2035 – 2.7 mln bbls/day The regional structure of commissioning will not change, more than 80% of new capacities will be in the countries of the APR, Africa and the Middle East. Herewith, there are not reliable estimates of decommissioning of the inefficient capacities, as there are no long-term plans for closure of refineries at the country level. Almost all forecasts for the period after 2025 are based on the balance of supply and demand, taking into account the minimum refinery load. For example, the OPEC estimates that the decommissioning of capacities in 2025–2045 cumulatively will amount to at least 6 mln bbls/day, of which about 3.5 mln bbls/day will fall to Europe [8].

Risks for Russian oil refining

After the completion of the current stage of modernization, Russia will significantly increase the production of light oil products, mainly motor fuels. Since there is a steady surplus on the domestic market, the bulk of the additional fuel volumes will be exported. However, the unfavourable environment in key foreign markets creates high risks for Russian export supplies.

Thus, in the European market, the largest for Russian processing, the import niche will narrow. Moreover, a significant part of the decline in demand in Europe will fall on the road transport segment, which consumes just motor fuels.

The situation is not developing in the best way in other segments of the consumption of petroleum products. Even in the most resilient air transport sector, the forecasts for the European market may be revised, as the region is already introducing technologies for the production of environmentally friendly types of bio-kerosene, which will partially replace traditional fuels. For example, the BP is planning to start processing solid household waste to produce low-carbon jet fuel [14].

Sources: [8], author’s calculations

It should be noted that the presented scenarios of demand for oil and petroleum products assume that the current policies in European countries with respect to fossil fuels will remain intact. However, due to the fact that such scenarios do not allow achieving the goals of the Paris Agreement, analytical agencies do not distinguish them as basic ones.

Herewith, forecasts, developed taking into account a more active climate policy, assume a drop in demand for oil and oil products in Europe is much stronger than in the scenarios of current policies. From the point of view of today’s public sentiment, just such scenarios look preferable.

However, they also do not stand out as basic for several reasons. The main one is the huge costs of transformation, which is why there are high risks of their implementation. In addition, with the transition of transport to alternative energy sources, an additional problem is a decrease in tax revenues from excise taxes on oil products. In the European Union, such revenues averaged 7% in 2018. Despite this, the development of Russian refining should consider the likelihood of the implementation of both scenarios of current policies and scenarios with more active climate measures. In other words, it is necessary to prepare for the fact that the outlook for demand in the European market may turn out to be even worse than current forecasts.

The difficult situation in the oil products market does not greatly soften the gradual withdrawal of primary processing facilities in Europe, since part of the refineries will be transferred or are already being transferred to the production of biofuels based on waste oils and fats. For example, by 2026 it is planned to commission about 0.8 mln bbls/day of such capacities [15]. Given these trends, biofuels will gradually replace traditional petroleum products.

In addition, as mentioned above, the situation on the European market is complicated by an increase in supply from refineries in the Middle East, whose commissioned capacities will cover with a large margin all the planned outlets of their own inefficient capacities. All of these factors create high risks of oversaturation in the key market for Russian oil refining.

In other markets that are more remote for Russian refineries, the situation is no better: both in the APR and in Africa, although demand is not expected to fall, herewith, their own refining capacities are being actively commissioned in order to reduce dependence on imports. Thus, potential aggravation of competition is expected in this region as well.

All these trends mean that in the near future, the domestic oil refining industry may face tough competition, primarily in the key European market.

Conclusion

Despite the current downward trends in demand until 2035, oil and petroleum products will continue to play a major role in the global energy balance. However, the least effective players will gradually leave the market, as is already happening now, for example, in Europe. In such conditions, the most important factor in the survival of oil refineries will be the presence of competitive advantages.

Russian oil refining, especially taking into account the planned completion of large-scale modernization, is already a competitive participant both in the global market in general and in the European market, in particular, even despite its remoteness from foreign markets and the associated high transportation costs for the delivery of oil products to external consumers. For example, the margin of domestic refineries in 2019 averaged 4.5 USD/bbl, while the European refineries had only 2 USD/bbl. One of the factors of the competitiveness of the Russian industry is the support of the state in the form of subsidies and additional allowances paid to the modernized enterprises. Thanks to this, the logistical lag of the factories located in the interior of the country is levelled.

In the current conditions of increasing competition in the world market, the key task should be to maintain support for the industry from the state in the long term. This task will become especially urgent given the climate agenda in Europe, within which additional carbon regulation may be introduced against Russian exports.

Let us recall that according to the Russia’s Energy Security Doctrine, one of the directions of the state’s activities is to protect the interests of Russian organizations in the FEC and to support the export of their products [16]. To maintain the volume of supplies to foreign markets of oil products from the state, it is necessary to preserve subsidies, oppose tariff and non-tariff restrictions, as well as build a carbon regulation system harmonized with the EU. Companies need to improve their competitiveness, meet modern requirements, diversify supplies, and production flexibility. Combining the efforts of the state and companies, it will be possible to get ahead of other exporters and to protect their own import niche in the European market, and in the future to occupy new markets.