Aleksei RYBCHINSKY

Self-Supporting Oil Trader, Cand.Sc. Law.

e-mail: ribchinsky@gmail.com

The energy relations of two states – of the Russian Federation and Belarus Republic – have close and significant nature for economies of both countries. it is a matter of common knowledge.

Belarus is one of the largest (the biggest among CIS countries) importers of the Russian petroleum feedstock. In particular, in 2020, from the total amount of oil supplied according to Transneft system 208,4 mln tons the share of Belarusian oil refineries made 13,3 mln tons of oil, which makes 6,38 % [1].

But it is far from indicative period: at the average the annual oil refining in Belarus is at the level of 18 mln tons, correspondingly increases an the Republic share in the Russian oil export. Current reduction of oil procurements is explained by the price dispute between the countries in the first quarter last year and negative influence of COVID-19 pandemia.

Periodically, not systematically, there are supplies of Belarusian motor fuel in the Russian domestic market. Petrols and diesel fuel are sold over Saint-Petersburg International Mercantile Exchange and via the subsidiaries of Belarus oil companies in the Russian Federation.

There was also signed the inter-governmental agreement between two countries, within the framework of which the terms and conditions were defined on transhipping the Belorusian oil products supplied to the purchasers by sea in the Saint-Petersburg ports Leningrad region ports.

However, there is one more area of the oil business, where the parties cooperate, – production of oil by Belarusian companies in Russia.

This topic is given undeservedly little attention, but it is its integrated part of bilateral economical and even political relations between the Russian Federation и Republic of Belarus, and, time after time, is raised at the highest level.

Reasons and Directives

Possessing two oil refineries with total capacity for refining up to 20 mln tons per annum, Belarus Republic has no sufficient feedstock base neither for loading its refineries for full capacity production, nor for provision of its domestic market needs.

The oil production in Belarus is at the level of 1.65–1.7 mln tons per annum [2], which is out of proportion with available production capacities of Naftan и Mozyrskij oil refineries. Moreover, for many years, all Belarusian oil is traditionally exported to Germany to oil refinery PCK Raffinerie in Schwedt (common ownership of Rosneft, Shell and Eni).

Dominating oil supplier to Belarusian oil refineries are Russian VIOCs (Vertically Integrated Oil Companies) with partial participation of small oil production companies, as well as insignificant share of deliveries of the so-called “alternative

oil” – hydrocarbon feedstock of foreign oil companies (SOCAR, Totsa, Saudi Aramco and some others).

Naturally, in such conditions the Belarusian producers are interested in obtaining individual access to exploration of the oil fields abroad in order to become the,fully valid vertically integrated oil companies, to improve oil refining economy, as well as their financial results.

This provision is directly embodied in the Concept of Energetic Security of Belarus, which stipulates the Belarusian oil companies the necessity for participating in development of oil and gas resources of the foreign states, as well as arrangement of subsequent supplies of the produced feedstock to the Republic [3].

However, of all possible regions of the world, where there are reservoirs of oil and they are developed, the Belarusian companies themselves physically produce and dispose the oil only in Russia. In other countries: Ukraine, Venezuela, Ecuador, – state production association Belorusneft provides only oilfield service to the players of the local markets or cooperates with them on that profile within the framework of joint ventures.

Attention Activation

In November 2020 there was a telephone conversation between the President of Belarus Aleksandr Lukashenko and the RF President Vladimir Putin on the purchase of the oil fields on the territory of Russia by the Belarusian party, after that the issue of the Belarusian oil production in the Russian Federation has become actual again.

The Press Relations Service of the Belarusian leader has made the following statement following the completion of the conversation: “President of Belarus addressed to the Russian college requesting possible purchase of the oil field in the territory of Russia. Vladimir Putin has supported this idea. After working out the question, the issue will be discussed in details during the nearest meeting” [4].

Link: автостекло74.рф

The next day the answer from Kremlin have come. Dmitry Peskov, the Press-Secretary of the President of Russia, has made a comment, that issue was raised by the Belarusian party but “there were no particularities in it, actually, that issue was raised by the Belarusian party, and it will be worked out in our relative ministries and departments”, – D. Peskov said [5].

The news has aroused wide interest among Belarusian and Russian mass media and was followed by the comments of a great circle of experts in the area of the energy resources, as well as of different status government officers.

However we see that after half a year the question of the Belarus production of hydrocarbons in Russia has not got its practical development. Let us try to explore the reasons, why the project actual for the Republic has not been started ye.

The first and the very important one: What was actually kept in mind?

First, on what many people paid attention: “to purchase” the oil fields on the territory of Russia is impossible, because they are the state property.

However here, for a certainty, we deal with inaccurate wordings of the Press Relations Service of the Belarusian President. As far as legally,in accordance with the Russian law “Concerning Subsurface Resources”, the company with the foreign participation can obtain the license for upstream, if will take part and won in the auction or the tender for development of this or that site of subsurface resources. Only the fields of federal importance with oil reserves from 70 mln

tons and gas from 50 bln cubic meters as well as the site located on the shelf or having strategic importance for security of the country, are the exceptions. To take participation in the auction or in the tender, the foreign company shall have the subsidiary registered in the territory of Russia.

Not newly ones, but not very big

It is worth noting that the Belarusian companies have been participating in development of the Russia subsurface sites and produce oil in the territory of Russia.

The first company with Belarusian share capital, which have joined to the area of oil production became YUKOLA-neft in 2002. The enterprise was organized by Valery Shumsky, the popular Belarusian businessman and philanthropist.

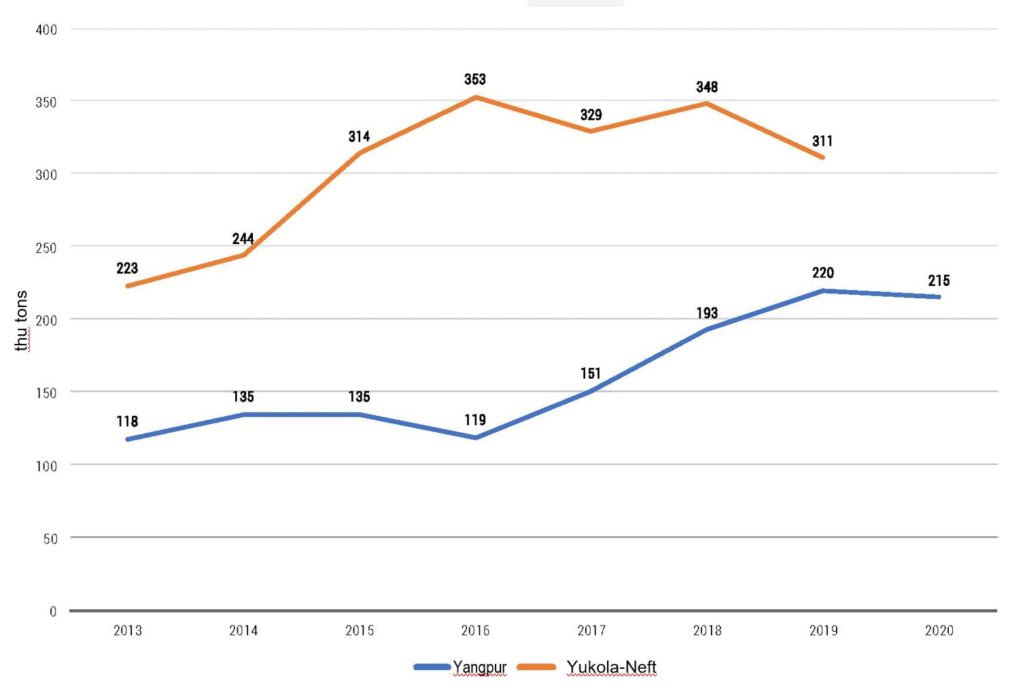

As of today, the company performs it activity on eight licensed sites located in Saratov and Samara regions. In 2019, LLC YUKOLA-neft produced 311 thu tons of oil [6] (the company did not disclose the data for 2020).

In 2013 one more Belarusian company State Production Association Belorusneft has purchased a small Russian oil production company Yangpur for 112 mln dollars possessing licenses on upstream at six sites in YNAO (Yamalo-Nenets Autonomous Okrug). Subsequently, LLC Yangpur was converted into JSC Oil Company Yangpur. Belorusneft owns, indirectly via its subsidiary, – LLC Belarusneft-Sibir (resident of the Russian Federation).

In 2020, the amount of oil production by the Oil Company Yangpur made 215 thu tons of oil [7].

Dynamics of oil production by the companies YUKOLA-neft and NP Yangpur can bee seen in the diagram (Fig. 1).

Links: LLC YUKOLA-neft, JSC NK Yangpur, RUE PA Belorusneft (republican unitary enterprise)

It is also worth noting that, time and again, both companies declared their rathe ambitious plans on increase of production on account of purchasing new sites and putting into operation of additional wells.

For example, as early as in 2015– 2017 YUKOLA-neft planned to increase its production volumes up to the level of 500–600 thu tons oil per annum [8]. However, they have failed to reach such indicators yet.

Toxic Asset with Belarusian “Trace”

But in the “Belarusian magazine case” of oil producers there i some more strong participant.

In 2012, the businessmen Yury and Aleksei Khotiny of Belarusian origin and well-known in Russia, who have earlier specialized in commercial real estate in Moscow, started to purchase different extractive industry enterprises and equity shares in them.

All in all in 2016, according to Forbes estimates, they have already controlled a great many of companies, with their total cumulative production reaching 2,5 mln tons [9]. Among them the largest assets had such companies as Dulisma stock of 29.9 % shares in Exillon Energy, Razvitie Peterburga, Negusneft, Khortitsa and a number of others.

It is unknown, to what result such buying in and consolidation of the oil assets, which were provided by, Yury and Aleksei Khotiny, would lead them, if it wasn’t for the Central Bank of Russia and the State Deposit Insurance Agency (SDIA) in 2017,

who had very serious questions concerning other area of their activities – the banking business (Yugra Bank). Subsequently, the credit organization was put under bankruptcy administration, and then the Arbitration Court of Moscow declared them bankrupts.

Aleksei Khotin was brought a charge on wasteful spending of bank Yugra assets (P. 4 A. 160 CC RF “Wasteful spending of another person property large-scale misappropriation by fraud”), At the moment, the affair is now under consideration.

Simultaneously, against the oil companies of Khotiny family clan and other judicial procedures are proceeded, because financing of transactions on purchasing the oil companies assets was made on account of bank Yugra bank, where the Belarusian businessmen have actually funded themselves.

In these judicial proceedings the central bank and SDIA try to impose a court-enforced collection on the Khotiny’s oil companies, and their owners, on the other hand, defend themselves with all available methods. There are questions to activities of individual oil companies and some oil structures on the side of FTS (Federal Tax Service), which tries to levy the funds that were not paid to the budget.

Where does the Russian oil produced by the Belorussian companies come?

YUKOLA-neft sells oil for export and to the Russian domestic market. In 2019, according to Assoneft, this ratio was as follows: 180 thu tons – export (57,9 %), 131 thu tons – RF domestic market (42,1 %). The main markets of export sales – Germany and Hungary. Oil Supplies YUKOLA-neft does not make supplies to Belarus Republic [10, 11].

NK Yangpur controlled by Belorusneft is mainly aimed at supplies of oil to Russia residents. The hydrocarbon feedstock to the Russian domestic market take the dominant share of it production.

Before 2020, the company’s export area, no matter how odd it looks, did not include Belarus itself. The volumes of the oil feedstock produced by NK Yangpur were included in the schedule of oil supplies to oil refineries of Belarus Republic only in the first quarter of 2020 against the backdrop of the oil price between Belarus and Russia, when the contracts for supply of hydrocarbon feedstock were not signed between Belarusian oil refineries and Russian VIOCs.

Economy and Financial Results

It is worth noting that both YUKOLA-neft and NK Yangpur, according to reporting, demonstrate satisfactory results of financial and economic activities and are assessed well enough among the companies performing business-analytics of the Russian domestic market

The given data evidence that YUKOLA-neft is in advance of NK Yangpur both by revenues and net profits. For all that, NK Yangpur has also the second area of activity – selling of associated petroleum gas and natural gas: in 2020 the company increased the volumes by three times and produced 870 mln cubic meters [12]. According to selected concept of NK Yangpur development, it is the gas area, which is of great priority [13].

Links: VLSI, RBC-companies

NK Yangpur oil company possesses more fixed assets as compared to YUKOLA-Neft: 5.93 bln rubles as opposed to 3.44 bln rubles, but cost of ton of oil sold it has higher than YUKOLA-neft: 17 403 rubles as compared to 14 008 rubles (or by 24.24 %), – the production level is lower [14].

Along with this, good enough financial results of both companies evidence that this business develops well in the corporate terms exclusively.

For Belarus Republic itself and its oil industry, operation of these two organizations in the Russian market has no crucial significance. Even if to send all volumes of oil produced by YUKOLA-neft and NK Yangpur to Belarusian oil refineries (approximately 540 thu tons of oil per annum), they will be enough only for one month of operation for one enterprise at approximately 70 % use of production capacities. However and this will be impossible, for under Russian law about 45 % of the produced oil shall remain the domestic market.

Only for satisfaction of Belarus Republic internal needs in the oil products (petrol, diesel fuel, diesel oil, LHCG, aromatics, oils and a number of other items) under current demand and refining depth at Belarusian oil refineries itis required approximately 6.5–6.7 mln tons of oil per annum.

it is evident that the operating Belarusian assets in Russian oil production industry do not comply with this requirement and are not able to increase production of the required amount of hydrocarbon feedstock even in the in mid-term perspective.

In addition, YUKOLA-neft is a private equity company and defines independently,where and who it will sell the produced oil. Belarus governmental bodies have no administrative instruments to obligate the company to supply the feedstock exactly to the Belarusian oil refineries. The only solution of this situation is an extensive way – active purchase and development of new licensed or buying of other operating players of the extractive industry. But, in order to get any results from this, a certain time should pass all the same.

Stumbling Point: Tax Manoeuvre and its Consequences

The tax manoeuvre conducted by the Russian Federation in the oil industry leads straightly to increase of the value of oil supplied to the Belarusian oil refineries. After 2024, the oil export duty will return to zero and finally it will be replaced with domestic revenue charges – MET-oil (mineral extraction tax) and EPT (excess-profits tax). At present, in negotiations withe Russian Federation, Belarus Republic is actively trying to get compensation for supplied hydrogen feedstock price increase.

Therefore, with unsolved problem of compensation, it does not matter by any means, who will produce and supply oil to: Russian VIOCs or subsidiaries of Belarusian companies.

Even if to get the fields for development, which cover the needs of both Belarusian oil refineries, al the same, the companies producing and exporting the oil to Belarus will be the tax residents of the Russian Federation and will pay all taxes to its budget.

We shall also note the following significant fact: after 2024, profitability of Belarusian oil refineries in case of exporting their oil products for long distances,seems to very doubtful. With the oil world price, the remote location of Belarusian oil refineries on the continent, just due to economic reasons, will narrow the geography for selling the products to the domestic market, where the relatively high prices are as early as since 2017, as opposed to prices in the markets of the neighboring countries. Cost increase and “long” logistics will rise the Belarusian oil products for long-distance export.

Therefore, Belarus does not need the oil as it is, but the cheaper oil, that is reduction of the prime cost for incoming Russian feedstock for Belarussian refining companies as compared to sales value of the Russian oil for foreign oil refineries.

As of today, compensation instruments are at disposal of the Russian Federation budget, which, would compensate the Russian refineries the difference of the reverse excise duty and the damper.

In 2019, the similar option was proposed to Belarus Republic: it consisted in signing the package of the so-called integration charts specifying synchronization of tax regulations for both countries and creation of the uniform taxing zone. This would enable to distribute the mechanisms of the reverse excise duty and thein Russia to Belarusian enterprises and the damper (within the framework of integration charts, a uniform Tax Code was discussed).

However, the Belarusian party has refused to sign all integration charts in the general package at the last moment. Result: the price dispute concerning the feedstock value, temporary interruption of its supplies to Belarus at the beginning of 2020 due to absence of signed contracts, as well as increase of Russian oil value in 2021 by 4–5 % as compared to last year up to 88–90 % of the Urals world price [15].

Perspectives on Company Level

It is worth to consider the available situation with expansion of Belarusian oil production in the Russian Federation in two aspects: corporative (on the level of companies) and within the framework of interstate relations.

As regards operation of Belarusian-owned companies in the Russian market in the oil production industry, there are not any barriers: come and take part in the organized auctions for licensed sites of subsurface sites, win and develop. Russian law concerning subsurface resources allows for doing it. No artificial barriers for Belarusian companies in the Russian market are built.

Link: kbolbik / Depositphotos.com

Here is a positive experience of work both LLC YUKOLA-neft, and ОJSC NK Yangpur. for example, the first actively purchases and new the license for the right to use subsurface mineral resources, as well as performs geological prospecting and exploration on the obtained licensed sites. In its turn, by purchasing Yangpur assets, PA Belorusneft has immediately received the oil fields of the company available in YNAO for development. But this did not stop Belarusian producer in replenishing his resource base: in December 2019 NK Yangpur the winner of the auction for the right of using subsurface mineral resources of Yuzhno-Tydeottinsky licensed site.

However, at this the activity of Belarusian players in Russian production of oil finishes. Despite the market transparence and understandable rules of play, there is interest on the side of other residents of Belarus Republic to participate in oil production in Russia.

To the point, the similar situation is in the fuel retail. Thus, possessing a great amount of export fuel resources (petrols and diesel fuel), developed system of oil tank farms located in the border areas, own park of oil-tankers, until now the Belarusian state companies did not enter the market of filling stations in the neighboring countries. This would allow the Belarusian fuel retail o reach the final buyer in the chain of pricing, and, as they call, “using fuel nozzle” and, as a result, get large profit.

At that, due to transfer pricing, the profit accumulation center can be formed directly in Belarus Republic and minimize the your tax expenditures in foreign countries by selling the fuel. However, they have given everything under complete control of local and international players of the fueling market from Lithuania, Latvia, Poland and Ukraine.

Therefore, even at the level of state Belarusneft and its approach to oil production in Russia, it is seen that Yanpur is an exclusively additional are of activity within the framework of development of own enterprises. The available issues in Belarus oil industry cannot be solved alone.

Perspective at the interstate level

Pay attention to the fact that the“request for purchasing oil field in the territory of Russia’ was made by Aleksandr Lukashenko in person to Vladimir Putin. They are the heads of states, and not the directors, for example, of the oil and producing company.

This fact characterizes excessive political nature of the energy-related relations of two countries, when the business issues are solved

not by the business entities, but by the government officers and politicians, although actually there is no need for it.

As shown above, Belarusian companies do not strive for developing business on oil production in the Russian Federation independently, and with it, due to giving the part of their profit back to Belarus and it could improve the Belarusian oil refining.

For example, in 2019, YUKOLA-neft profit as per ton of produced oil made 3 115.11 rubles or 48.2 USD (at average exchange rate in 2019). In case the needs of Belarus domestic market were met by the oil company under control of Belarusian state, even by the way of withholding half of the profit in the form of dividends, it could be possible to reach the total saving of oil import of 10.4 bln rubles (161,5 mln. USD).

The similar structure could be definitely possible to create based on the existing second-tier subsidiary state company Belarusneft – NK Yangpur.

At that, Belarusneft has all prerequisites for such project implementation: experience in prospecting and exploration, drilling and production; own staff and school for training specialists; technology and required equipment, lean business processes.

The only moment is the need for funding Belorusneft in order to ensure possibility for the enterprise to purchase new licensed sites, extend its activity and purchase already operating oil assets of other production companies.

It is worth recalling that at the beginning of 2000s, Belarus made efforts for creating a group of production companies and by means of own equity capital which could provide the country domestic market by supplying required amount of hydrocarbon feedstock, but this initiative did not have support in the Belarusian authority highest echelons. Such project was not even presented. for consideration.

The Concept of Belarus Republic energy security, where the necessity for oil production out side the country was adopted in 2015. However, six years after this only looked good on paper. No actual actions were undertake on the side of the state and Belarusian companies, to organize significant expansion of production in the Russian Federation.

Thus, we have to state that, when the mater in implementing and developing oil production in the Russian Federation territory, there is significant, in the declared and announced wishes by

the Belarusian party and other practical actions.

To shift this “tectonic formation” of the evident necessary to implement particular actions only the Belarus authority can, when they form clear, consistent and realized into practice strategy for participation in development of the oil fields in the Russian Federation, as well as particular mechanisms for its implementation.