Arseniy POGOSYAN

Correspondent of the magazine «Energy Policy»

e-mail: pogosyanas@minenergo.gov.ru

Abstract. The article is devoted to the development of projects for the production of liquefied gas in Australia. Describes in detail the process of the country’s transformation into the largest LNG supplier to the world market. Much attention is paid to the impact of the coronavirus epidemic on the global LNG market and the volume of Australian exports. Separately, the article touches on the problem of the continent’s internal gas market. The author comes to the conclusion that gradually, against the background of the global energy transition, LNG is beginning to yield to other energy sources such as hydrogen.

Keywords: liquefied natural gas, LNG export, investments, hydrogen production.

LNG through the lens of a pandemic

It is unlikely that at the end of last year or the beginning of this year, anyone could have predicted what a large-scale impact the COVID-19 pandemic would have on all areas of the world economy – from cheese to oil and gas production. Encouraged by the rate of liquefied gas consumption steadily growing by 9–12 %, the transnational giants of the oil and gas industry and banks vied with each other to predict an explosive growth in demand for LNG by 13–17 % in the next few years. Optimism supported the growing global trend towards the use of “clean” energy sources, primarily natural gas. And a prolonged period of low oil prices threatened with a capacity shortage and an excess of LNG demand over supply by 2022. Already in 2019, investments in natural gas liquefaction facilities grew by 12 % to a record $65 billion, which gave reason to expect an increase in global capacities in the next 2020 by another 16 %. Only six months of life in 2020 was enough for the same top analysts to give directly opposite forecasts.

Today, the global LNG industry is in a state of uncertainty – a keyword

that probably applies to almost any commodity market. Taking into account that

in 2019, it was announced the launch of several projects at once in different

parts of the world (in the USA, Africa, Russia), this year will be the first

since 1998 when not a single final investment decision on new LNG projects was

made. According to Platts, the drop in global gas prices resulted in a massive

postponement of new liquefaction capacities. As a result, 2020 has every chance

to become the most shocking year for gas markets in recent decades, both in

terms of decrease in demand and prices, and investor interest in the LNG market

deified over the past 5–6 years. In the first six months of 2020 alone, global

consumption of natural gas decreased by 4 %, and by the end of the year,

the decline can be sustained if buyers do not intensify LNG purchases in the

winter and thus do not support at least gas sales volumes.

At the beginning of the year, as noted by the head of Global Gas Market Research, Christie Kramer, the drop was less obvious – the global demand for gas fell by only 2 % per month due to the steady demand for gas in a number of industrial sectors, primarily power plants and thermal power plants. The coronavirus factor became clearer only in the situation of an oversaturated gas market, which is already repeating in general terms the situation on the world oil market.

Source: SHELL

The most sensitive to the “sagging” price in the LNG wholesale market appeared several American projects: Freeport LNG, Golden Pass, Texas LNG and Cameron, the operators of which were forced to postpone the final investment decisions previously planned for 2020. At the moment, a total of 123 million tons of capacities are under construction – and this, nevertheless, is one of the highest indicators in the last 20 years.

The market recovery is also postponed due to large gas reserves in European UGS facilities and a slow recovery in industrial demand. LNG owners are already accustomed to previously “reserve” refusals of buyers from deliveries – since February, a number of Chinese and then Indian importers began to abandon previously concluded contracts for LNG production. According to media reports, even supplies from a trading subsidiary of Gazprom to the Indian GAIL fell under the announcement of force majeure.

However, as early as August 2020, Asian wholesale prices began to gradually level out, which was due to several Australian plants – the world’s largest floating LNG plant Prelude FLNG and Gorgon LNG – that extended their repair period and thereby reduced the supply on the market. Calling a simultaneous refusal to exit repairs as a cartel conspiracy to raise prices would probably be an exaggeration, but the fact itself is indisputable – only a few plants with a total capacity of up to 20 million tons in faraway Australia can play a significant role for the global market with a turnover of 300 million tons.

Try on the leader’s role

Despite the relative seclusion on the world map, Australia has long been firmly established in the world FEC. Being the “coal queen” in the recent past, it is gradually diversifying its exports, conquering new markets from LNG to renewable energy and hydrogen production. Australia was not lucky with oil – in the structure of hydrocarbon reserves, oil occupies only 30 %. At the same time, most of the reserves (about 441.8 million tons) are hard-to-recover. Oil production in the country does not exceed 0.3 million bpd. As a result, Australia chose gas as its new “trump card” in the struggle for a foreign buyer. Thus, the proven gas reserves over the past 10 years, according to BP Statistical Review 2020, have grown by 50 % – to 2.4 trillion cubic meters from 1.6 trillion in 1999. These volumes include the explored reserves of unconventional coal bed gas (CSG, also called coal bed methane).

In addition, Australia ranks seventh in the world in terms of shale gas reserves, the volume of which reaches 12.2 trillion cubic meters.

Most of this gas (up to 80 %) comes from offshore deposits located around the continent. The “shale revolution”, which greatly influenced the global oil market, made Australia one of the leaders in the world gas production – since 2009, gas production in the country has tripled – from 46.7 billion cubic meters to 153.5 billion cubic meters – only Iran had comparable dynamics.

There are three main gas provinces in the country:

– Western Australia Gas supplies are carried out from the field complexes of the Carnarvon offshore basin. This is more than 64 % of the gas for all exported LNG;

– Northern Territory. Offshore basin Bonaparte and continental Amadeus, accounting for up to 2 % of production;

– Eastern and South Australia. It includes Gippsland (share in production is about 11 %), Otway (about 5 %) and Bass offshore basins, as well as continental ones – Cooper / Eromanga (5 %) and Bowen/Surat).

One of the main obstacles to the development of the continent’s gas industry is the isolation of these gas provinces both from each other and from places of direct consumption on the continent.

Another 11 % of production is provided by coal bed methane produced in the north-east of the country. Methane production is somewhat similar to shale gas production – it requires hard drilling, but the productivity of wells is low.

Source: oedigital.com

Source: QGCinfo / Flickr.com

Provided that methane production technologies become cheaper or LNG prices rise, Australia has every chance to increase its gas production by another 60 billion cubic meters by using CSG

Australia has been exporting liquefied natural gas (LNG) since 1989, but its emergence as the world leader in LNG exports was about as unexpected as the appearance of Australian Vladimir Jamirze among the bidders for the purchase of Bashneft in September 2016. Australians were not considered major LNG investors in the shadow of American projects. But in 2014, analysts at the Oxford Institute for Energy Studies cautiously predicted Australia’s leadership in the global LNG market by 2018 with a capacity of 87 million tons. The experts were only one year wrong. In 2019, Australia finally overtook the permanent leader – Qatar – to become the largest exporter of LNG with a production of 78 million tons of LNG – versus 75 million tons from Qatar. The country owes this growth to the appearance of a dozen new LNG terminals throughout the continent, including on the eastern market.

Most of Australia’s gas reserves lie on the bottom of the Indian Ocean near the northwest coast of the country. It is far from the largest cities in the country, but close to the largest importers – Japan, South Korea, China, and India.

LNG export by Australia in 2009–2019

Source:

according to BP Statistical Outlook 2020

That is why investors believe in Australia and invest huge amounts of money in its projects. So, the Pluto project, being developed by Woodside, received investments in the amount of 11 billion, and the project the Gorgon, implemented by such giants as Chevron, Exxon Mobil and Shell, – more than $50 billion. Over the past 5–7 years, these same global giants have successfully got rid of relatively large refineries in Australia – due to the explosive growth of the LNG market, investments in Australian oil production are falling noticeably.

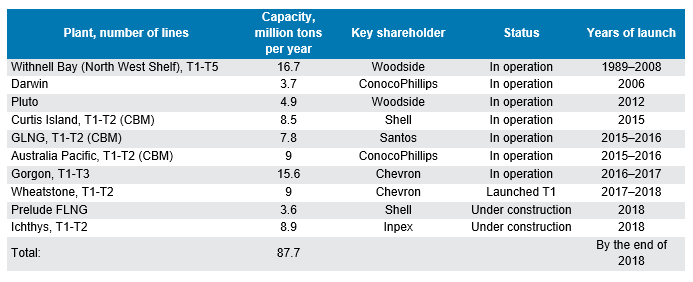

By the beginning of 2020, 10 large LNG plants with a total capacity of 88 million tons were built and operated in the country in different parts of the continent. Despite the fact that many of them were launched in 2016–2018, that is, during a period of low oil prices (Australian LNG prices are tied to oil prices), all of them were launched on time and maintain a high level of capacity reservation – from 70 up to 90 % as of the 1H 2020. In only two projects, the final investment decision has been pushed back to 2021 in light of the pandemic – the Scarborought FLNG floating LNG plant and the second line of the Pluto project. In February, even before the global pandemic and the collapse in prices, the floating Prelude FLNG was temporarily shut down.

External successes and internal problems

Japan has become a traditional market for Australia since the mid-2010s – the growing needs of the country of the rising sun for cheap gas could not be fully satisfied by Russia. Japan was actively looking for gas in other regions as well.

Domestic gas market, main gas pipelines and LNG projects of Australia

Table 2.

Australian LNG plants in operation and under construction

Source: Energy Center of the Moscow School of Management SKOLKOVO according to media and company data

In 2017, Japan accounted for more than 50 % of all LNG exports from Australia, while China accounted for less than a third (28 %)

Gradually, with the introduction of more and more new projects, Australia begins to conclude new long-term contracts with China, which has been purchasing coal from the continent for decades. Over the past ten years, China’s gas needs have been constantly growing. Taking into account that China, according to BP, consumed no more than 8 billion cubic meters of gas in the form of LNG in 2009, in 2019 the volume reached 84.8 billion cubic meters. By this time, Australia provided up to half of the entire need of China for imported LNG – almost 40 billion cubic meters was supplied each to China and Japan.

This interest of Australia in China is explained not only by a large competitive market, but also by the interest of investors in Australian gas. The Chinese state-owned company CNOOC, for example, funded the construction of the Curtis LNG.

Growth of Australian LNG export for new projects 2005–2019, billion cubic feet per day

In total, in the period from 2014 to 2019, investments in Australian LNG projects were, according to various estimates, from $180 to more than $200 billion. In addition, LNG imports to Japan are expected to gradually decline over the long term, depending on the reopening of nuclear facilities.

Meanwhile, the interests of transnational corporations representing the Chinese people are beginning to bother and, in fact, threaten the energy security of Australia itself, which, in turn, poses a great danger, including for maintaining a high level of LNG exports.

The growth in gas production, following the logic, caused increase not only in its export, but also in domestic consumption – from 29 billion cubic meters in 2009 to 54 billion cubic meters in 2019. Although almost two-thirds of Australia’s electricity continues to be generated from coal, the share of gas in generation is steadily increasing.

Paradoxically, along with the growth of gas generation, there is an increase in population’s discontent. Most of the gas in the eastern beds are CSG shale and unconventional formations, hydraulic fracture and other operations carried out by the companies have already caused a number of social and environmental concerns, resulting in a ban on the exploration for unconventional gas in several states.

The main problem of the mainland’s internal market is the isolation of the three gas production areas. As a result, the decline in gas supplies to the population in one production area cannot be compensated for by supplies from another area. In 2017–2019, following the prices of export LNG, domestic retail gas prices also almost doubled, which led to an increase in electricity prices for the population.

at the Nasa ground station in Australia

Source:

European Space Agency / Flickr.com

There have been cases when the cost of gas in the domestic market was higher than that under export contracts with Japan. To smooth the situation, the government is doing everything possible to reform the gas market. The aim is to make the gas pricing mechanism more transparent and to demonopolize gas infrastructure. The length of gas pipelines in the country reaches 47 thousand km, but most of them are owned by several companies, which results in the absence of transparency when forming prices for gas transportation. At the same time, the leading country in the export of liquefied gas is already beginning to implement projects for receiving LNG terminals.

Until the government finds a suitable solution, the situation of competition for gas between the domestic consumers and the consumers from the Asia-Pacific region will continue in Australia. Maintaining the status quo is impossible – due to a lack of gas in 2016, the country faced, for example, a power outage in the state of South Australia. In November, Woodside, the operator of North West Shelf LNG, admitted the possibility of a scenario in which it would have to start shutting down liquefaction lines at its plant due to a lack of feed gas. In this situation, the population can only rely on themselves – and massively purchase solar panels, thanks again to China, which have significantly dropped in price over the past few years.

LNG retreats into the shadows

Against this background, 2020 is becoming a good reason for Australia to test and reconsider its approach to working in the global LNG market, probably losing the palm of victory. In September, Australia’s Department of Industry, Science, Energy and Resources reported in its Quarterly Resource and Energy Newsletter that LNG exports fell by 12 % year on year. Moreover, according to the report, some buyers exercised their right to cut contract purchases by about 10 %. Earlier, before the onset of the pandemic, the department forecasted an increase in LNG exports by Australia to 81.3 million tons. Now, LNG exports from Australia are expected to decline from 78 million tons in 2019 by 2 million tons – to 76 million tons in 2020.

Source: Beyond Coal and Gas / Flickr.com

According to officials, the outlook for the next wave of investment in Australian LNG projects is still dim due to weak market conditions leading to delays in investment decisions and cuts in capital costs. Changes will influence not only the behavior of the government and companies, but also of their sponsors: the larger the project, the more difficult it will be to obtain the necessary bank financing, unless it has strong government support.

Alternatively, Australian regional authorities are considering new energy sources as a promising export product, namely hydrogen. So, a whole agglomeration of renewable energy units with a capacity of 23 GW is already successfully operating in Australia, producing pure hydrogen from water using the electrolysis process. In parallel, the Japanese company Kawasaki has prepared a project for the production of hydrogen from cheap brown coal using the gasification method. Therewith, the production will be equipped with special carbon traps. Finally, the Australian company Global Energy Ventures has prepared a hydrogen tanker project, which is now being coordinated with experts. If all goes well, in a few years Australia will enter a new hydrogen market free of competition, the prospects of which have yet to be calculated.