Valentin NAZAROV

Professor, PhD in Economics,

Chief Scientific Officer

JSC «VNIGRI-Geologorazvedka»

St. Petersburg, Russia

e-mail: nazarovvi2012@yandex.ru

Oleg KRASNOV

Professor, PhD in Economics,

Chief Scientific Officer

JSC «VNIGRI-Geologorazvedka»

St. Petersburg, Russia

e-mail: KrasnovOS@rusgeology.ru

Ludmila MEDVEDEVA

PhD in Economics,

Team Manager

JSC «VNIGRI-Geologorazvedka»

St. Petersburg, Russia

e-mail: lyudmila.v.medvedeva@mail.ru

The current stage of development of the world economy is characterized by emerging trends in the change of the energy base. The proclaimed decarbonization, large-scale efforts to replace hydrocarbon energy sources with renewable ones necessitate a thorough analysis of the importance of the most efficient types of fuel – oil and gas – in the global fuel and energy balance and an assessment of the impact of the emerging trend on the Russian oil and gas complex.

Russia possesses a powerful resource base that allows it to fully meet its own needs for oil and gas and occupy one of the leading positions in the global energy market. Herewith, the changes in global energy consumption taking place in recent years present new, much more stringent requirements for the country’s hydrocarbon resources, which should ensure its competitiveness in comparison with other types of energy raw materials and alternative energy sources [1].

Oil and gas in modern realities are gradually losing the status of strategic resources, and their advantage as sources of primary energy should be determined, first of all, by economic factors. Cheap hydrocarbons may remain basic energy sources for a long time, but their role as a source of rich oil and gas rent is shrinking.

There are different points of view regarding the future of the global oil industry. It has been suggested that it will lose its position in the first third of the century and, in general, this century will be the century of gas.

According to the most radical views, the world energy industry will generally give up fossil fuels by the end of the century.

The most pressing issue is the long-term prospects for oil production for Russia. The explored profitable oil reserves in the country at the current price level, according to some estimates, do not exceed 10 bln t, which is clearly not enough to maintain the achieved production level for a long time.

There are also big problems in the gas industry. Russia possesses a huge natural gas resource base. Herewith, a significant amount of produced gas is exported.

The oversupply, which has recently appeared on the world markets, as well as oil, has led to the fact that prices for hydrocarbons are at a low level, and the profitability of the development of even large fields is decreasing. For this reason, many gas fields are idle for a long time.

It is obvious that in the context of the aggravated competition in the oil and gas markets and the trend of replacing hydrocarbons with alternative energy sources, strategic decisions on the scale and rate of development of energy resources should be made, first of all, on the basis of an economic assessment of the oil and gas facilities included in it at all stages of their study and development.

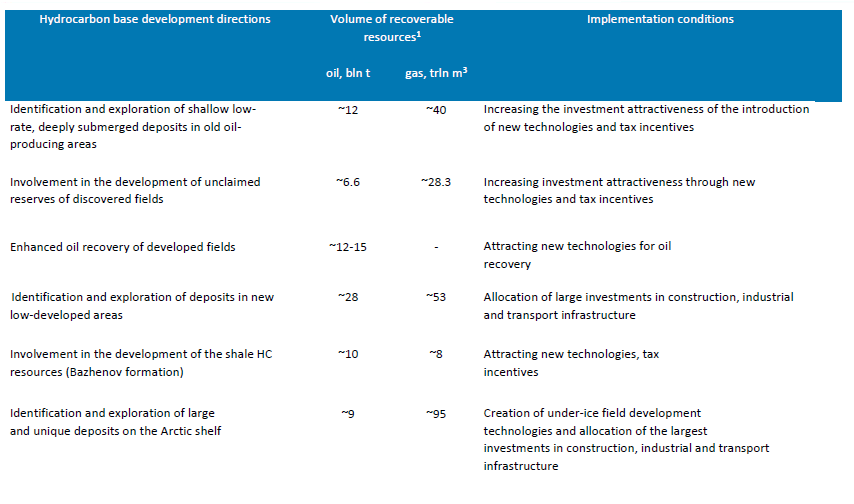

When substantiating the strategy for the development of hydrocarbon resources of the Arctic shelf [2], it is necessary to consider the alternative sources of hydrocarbons available in the country, which in their scale can compete with the Arctic resources. All competing sources of hydrocarbon resources can be conditionally divided into six groups (tab. 1).

The resource potential of some of these areas is approximately commensurate, but the efficiency of prospecting and exploration of deposits in them will differ significantly.

The directions of development of the hydrocarbon base considered in the table can be divided according to the timing of the implementation of the groups of resources included in them into medium-term and long-term.

The first medium-term direction of implementation includes resource groups that do not require large volumes of investment. Their industrial development can be ensured through the introduction of domestic or foreign innovative technologies and the use of tax incentives.

As part of the first direction, groups of small, low-flow rate, deeply submerged deposits located in old oil-producing regions with developed infrastructure can be considered. Geological exploration work is ineffective here, since it leads to the discovery of small deposits, the reserves of which do not exceed 1 mln t of oil. For instance, in Western Siberia in recent years, more than 200 new fields have been discovered, which turned out to be unprofitable when the oil price is less than 100 USD/barrel. [1].

However, in the future, the development of new technologies for the extraction of hydrocarbons and tax incentives can increase the investment attractiveness of such facilities and stimulate their involvement in industrial turnover.

Similar conditions are required for the development of unclaimed reserves of discovered oil and gas fields. Most of these fields are also located in areas with developed oil and gas production and do not need large infrastructure investments.

Another area of hydrocarbon development, which does not require huge investments, is associated with increased oil recovery.

An increase in the oil recovery factor from 28 to 40% (as provided for in the Energy Strategy until 2035) will additionally introduce into industrial circulation, according to various expert estimates, from 12 to 15 bln t of oil. However, the volume of oil and gas resources of the first direction put into industrial circulation is significantly lower than in the groups of resources of the second direction, the development of which requires the use of new, in some cases, technologies that have not yet been tested in practice and huge volumes of investments with payback periods calculated in tens of years.

The direction of involvement and exploration of oil and gas fields in new low-equipped areas has not lost its relevance. According to the latest estimate of the forecast resources, up to 28 billion tons of geological resources of oil and 53 trillion cubic meters of gas are forecasted in these regions. Realization of this potential requires the allocation of large investments in field development, industrial and transport infrastructure.

Shale resources can be considered as one of the new main lines of development of Russia’s hydrocarbon resource base competing with the shelf. According to expert estimates, the volume of recoverable shale oil resources in the country makes about 10 bln t [6]. Herewith, the explored reserves of this formation are still in the tens of millions of tons, and the huge resources of shale gas have not been studied either. The profitability of developing this type of resource has not yet been assessed.

In these conditions, it is obvious that offshore projects for their industrial promotion must have better technical and economic indicators in comparison with alternative onshore projects.

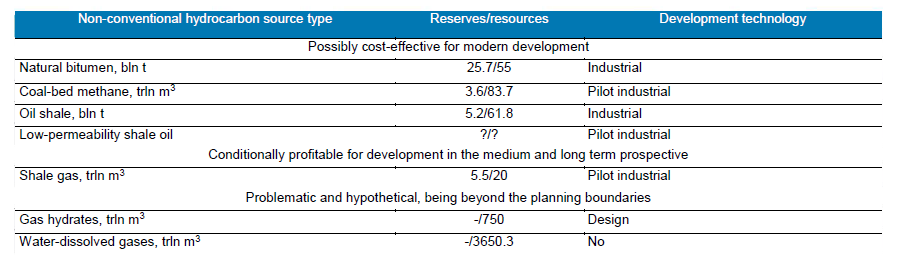

When assessing Russia’s hydrocarbon resource base, it is also necessary to consider unconventional types of hydrocarbon raw materials.

The geological resources of this group of hydrocarbons are much higher than the traditional accumulations of oil and gas in Russia (tab. 2).

Based on the available technologies, it is possible to single out a group of areas that may be profitable for industrial development, which includes natural bitumen, coalbed methane, oil shale and oil from low-permeability shale. For this group of hydrocarbons, there are either real or pilot industrial development technologies, and their involvement in development is determined only by market conditions and the profitability of development.

As for shale gas, given the possibility of a traditional raw material base of natural gas, the real terms of its industrial use are seen in the very distant future.

The last group of unconventional hydrocarbons, including gas hydrates and water-dissolved gases, can currently be considered as an object of scientific study.

Real technologies for the development of these types of resources do not yet exist. However, in some countries that do not have a hydrocarbon resource base at their disposal, in particular, in Japan, scientific research is being performed to develop appropriate technologies.

One should not forget about another promising energy source – hydrogen. The technology of its use is still at the initial research stage, but with the successful solution of technical and economic problems, this source of energy supply may well take a leading place in the markets of energy raw materials.

A brief review of traditional and unconventional types of hydrocarbon raw materials, as well as alternative energy sources shows that in the long term, the scale and rate of their use will depend on a number of factors, among which various combinations of geological, technological, environmental, economic and political factors.

Depending on the change in the influence of the listed factors, the pace and scale of putting into industrial circulation the Arctic oil and gas shelf of Russia will change.

Geological factor

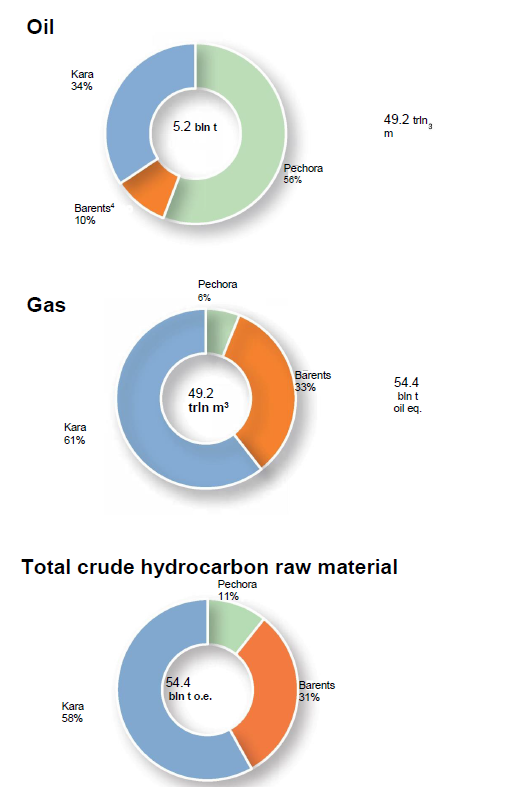

The hydrocarbon base of the Arctic shelf at the present stage of its exploration is considered mainly as gas-bearing. Of the total hydrocarbon potential exceeding 50 billion tons in terms of liquid hydrocarbons, oil accounts for just over 10%.

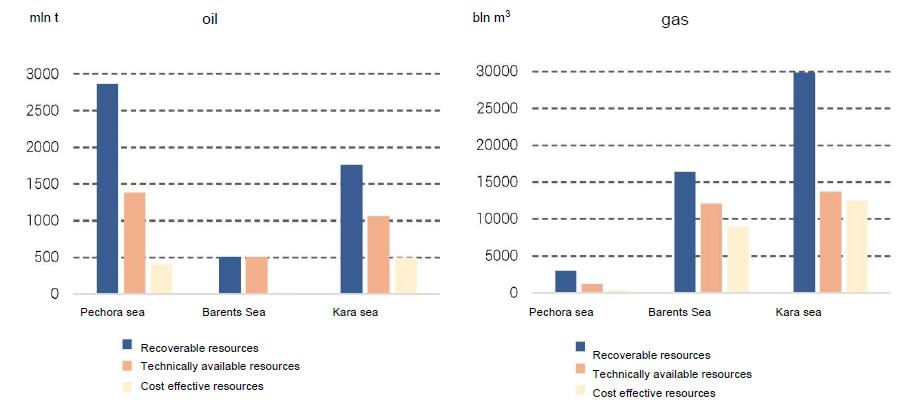

Moreover, more than half of the oil resources are in the Pechora Sea (54.8%) and a third – in the Kara Sea. Most of the gas resources are predicted in the Kara Sea (60.6%) and in the Barents Sea (33.3%) (Fig. 1).

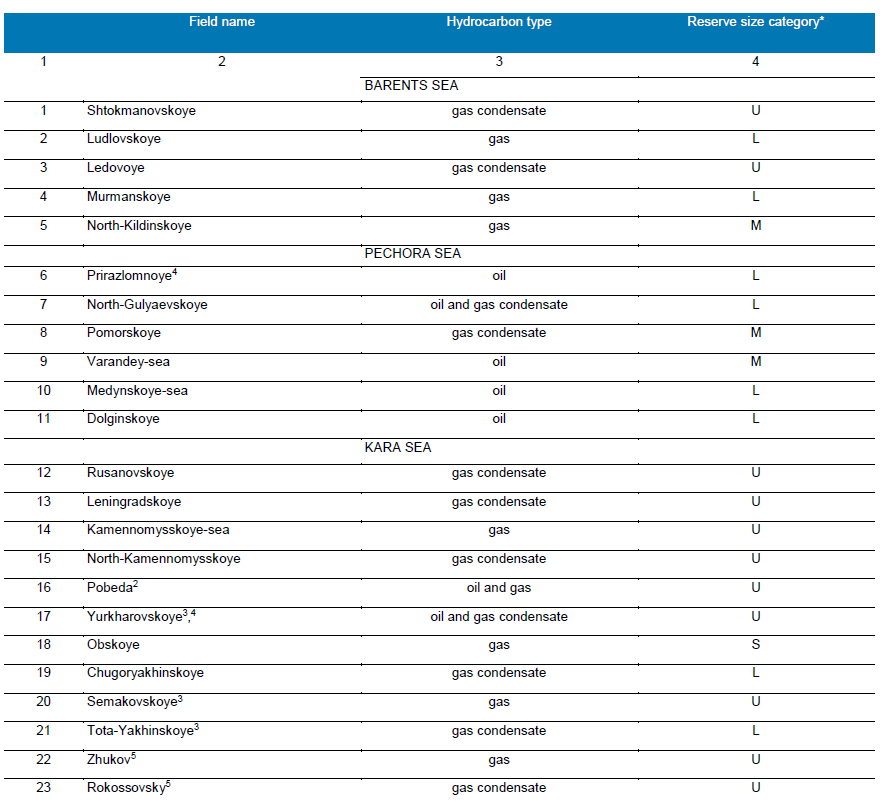

The extent development of the Arctic is extremely low. At present, 23 fields have been identified within its limits – 4 oil, 8 gas, 1 oil and gas, 8 gas condensate, 2 oil and gas condensate. Most of the identified deposits, according to the current classification, are unique and large.

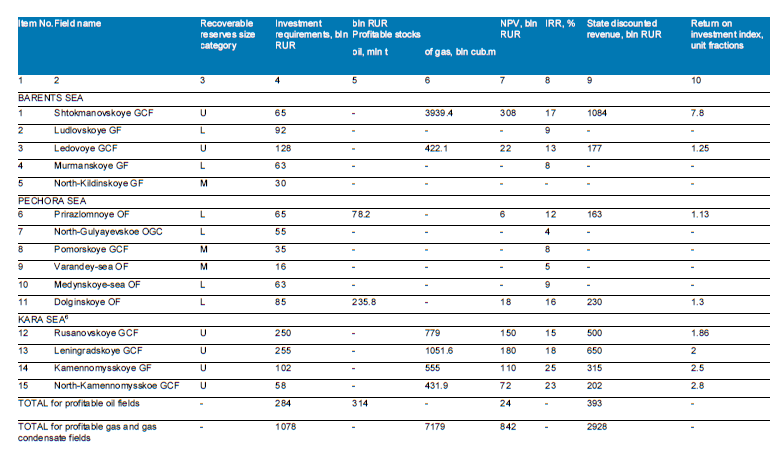

Only the Prirazlomnoye oil field (production is performed using an offshore ice-resistant stationary platform) and the Yurkharovskoye gas condensate field (production is performed from the shore by horizontal wells) are in commercial development. The rest of the fields have been awaiting additional exploration and industrial development for a long time (tab. 3).

The exploration of the oil resource base of the Arctic shelf is only about 10%, the gas – about 20%. Most of the discovered deposits have a low degree of exploration and need additional exploration.

Technological factor

One of the main conditions determining the possibility of involving the Arctic hydrocarbon base in industrial circulation is the technical availability of oil and gas fields for exploration and development.

The technical availability of hydrocarbon facilities depends on the following main factors:

– ice conditions;

– the depth of the sea in the area of the field;

– remoteness from the coastline;

– availability of technologies for field development.

Ice conditions are one of the limiting factors limiting access to resources. With a significant ice thickness and sea depths of more than 50 m, the arsenal of technical solutions associated with the development of offshore oil and gas fields and partly with the conduct of geological exploration is limited, since under strong dynamic loads

arising due to the movements of powerful ice fields, any technological solutions based on the use of self-elevating and semi-submersible platforms are practically inapplicable. The use of gravity platforms for technical and economic reasons is also limited to a sea depth of 50 meters. At great depths, the purely technical risks of operating such bases increase to an unacceptable level and the cost of their construction increases sharply. This circumstance narrows the oil and gas zone that is technically accessible for industrial development.

Certain technological problems are also associated with the development of the shallow part of the shelf (depths less than 5–10 m), where restrictions on the use of gravity platform bases are associated with their transportation to the point of installation, as well as with the organization of transportation of extracted products. One of the technical solutions here can be the use of artificial piled structures (artificial islands) with ice protection of these foundations. For coastal offshore fields, deep drilling and offshore development through the use of the surface drilling equipment and drilling wells with significant deviation from the vertical (by analogy with the projects on the Sakhalin shelf and in the Ob Bay).

To date, there are no proven technical solutions related to the development of hydrocarbon potential at sea depths of more than 50 m in difficult ice conditions in world practice. Separate elements of technical solutions for such conditions are being worked out, but neither the timing of their implementation, nor the degree of completeness and complexity of solutions that are required in such physical and geographical conditions are not clear. This makes it impossible to assess not only the technological efficiency of such developments, but also to characterize their capital intensity and the volume of operating costs, without which the geological and economic assessment of projects is impossible.

Recoverable HC reserve size category

by the classification of reserves and probable resources of oil and combustible gases:

U – unique (more than 300 mln t of oil or 300 bln m3 of gas);

L – large (from 30 to 300 mln t of oil or from 30 to 300 bln m3 of gas);

M – medium (from 5 to 30 mln t of oil or from 5 to 30 bln m3 of gas);

S – small (from 1 to 5 mln t of oil or from 1 to 5 bln m3 of gas);

VS – very small (less than 1 mln t of oil, less than 1 bln m3 of gas).

2 The filed is beyond the technically accessible area.

3 Offshore continuation of the onshore field.

4 Under development.

5 The field was discovered in 2020, its reserves have not yet been accounted.

The severity of this problem relates primarily to the formation of the operating well stock, since at the current level of development of technologies and technical equipment of specialized drilling platforms, the construction of exploration wells with their full testing is guaranteed to be performed within 2-3 months, that is, in the ice-free period.

A partial solution to the problem of industrial development of fields in conditions of continuous ice cover is possible with the implementation of technologies based on subsea completion of production wells,

their underwater arrangement using manifolds and connecting this part of the operating fund (production and injection wells) to the production and technological complex located at technically accessible depths (gravity platform or artificial embankment, natural foundation – an island or mainland). However, these technological solutions have spatial limitations associated with the maximum permissible length of underwater mains, which is due to pressure losses in them. For example, the maximum length for gas facilities achieved in the unique Snowwit project (Snow White, Norway) is 143 km (the multiphase flow is delivered directly to the shore, to the LNG plant).

This solution requires the use of unique and expensive equipment that excludes the differentiation of reservoir products into gas and liquid phases during their movement through the pipe. For oil facilities, possible delivery distances are limited to a maximum of 20-30 kilometers.

Each of the technical and technological solutions for the arrangement of oil and gas facilities has its own economic expression, depending on the type of platform or foundation (shore, artificial island, truss platform or gravity ice-resistant platform, semi-submersible platform, etc.). These facilities differ both in cost and in terms of operating costs. The costs of their construction largely determine the volume of the total investment load, its dynamics over time and the profitability of the project.

Thus, when assessing the real hydrocarbon potential of the shelf resource base, it is necessary to consider the existing or prospective technical means that ensure the availability of oil and gas facilities for deep drilling and subsequent development. The resource base that goes beyond the zone of technical accessibility should be considered as technically inaccessible, and its resource potential should be excluded when forming long-term programs and plans for the development of offshore production projects.

Transport factor

An important feature of the Arctic shelf, which requires consideration when assessing its economic significance, is the transport accessibility of oil and gas facilities.

When solving transport problems, it is necessary to consider several possible options:

- Organization of transportation of produced products directly from the production platform (offloading oil or condensate from the platform to tankers – linear or shuttle – and its delivery directly to sales markets, as implemented in the project for the development of the Prirazlomnoye field in the Pechora Sea, gas liquefaction directly at the production or a nearby process platform and offloading LNG directly). The product tanker transportation option in difficult ice conditions will require the construction of a specialized fleet of ice-class oil or LNG tankers, which are significantly more complicated in the technical part and much more expensive than traditional “non-ice” vessels. The fleet of such tankers can amount to tens of units – depending on the directions of supply and their volumes and, accordingly, will require huge material and financial resources.

- Organization of transportation of products to the coast using a pipeline system and integration of the marine transport infrastructure into the existing or newly created onshore transport infrastructure (by analogy with the Sakhalin projects or projects for the development of the Ob and Tazov bays on the Kara shelf). This is the most realistic option and for promising objects of the deep-water part of the Kara Sea shelf.

- Transportation of gas from fields to shore, its liquefaction onshore and supply to consumers using a tanker fleet – this option is being implemented by NOVATEK as part of the Yamal LNG project based on the South-Tambeyskoye onshore gas field, where, as a of services involved the tanker capacities of Sovcomflot.

The choice of the optimal transportation option should be performed on the basis of technical and economic calculations.

Environmental factor

The technologies applied in the Arctic shelf conditions must guarantee absolute safety at all stages of work. In the event of emergencies and environmental incidents, funds for damages should be reserved as part of the development costs. Taking into account the world experience in the elimination of accidents associated with the development of offshore fields, the amount of the insurance reserve can reach billions of dollars.

For example, the crash of the Exxon Valdez tanker off the coast of Alaska in 1989 led to a spill of 260,000 barrels of crude oil and pollution of 1,600 km of the coastline. However, Exxon spent approximately 2 bln USD to clean up the spill and another 1 bln USD to settle related civil and criminal charges.

In a similar accident at the Deepwater Horizon drilling platform in the Gulf of Mexico, which spilled about 5 million barrels of oil into the sea, BP incurred multibillion-dollar costs to clean up the spill and paid huge fines (the total financial costs of the company related to the liquidation of the consequences of the accident exceeded 60 bln USD). Due to the huge losses incurred as a result of the accident, BP was forced to sell assets around the world.

Accounting for such costs in the cost estimate of offshore projects can significantly affect their technical and economic performance.

It should be noted that today in the world there are no effective technologies for eliminating emergency oil spills or gas emissions in ice conditions. Considering that ice cover on the Arctic shelf lasts up to 7–10 months a year, this aspect should be given special attention.

Economic factor

The economic factor is of decisive importance in justifying the pace and scale of the development of oil and gas resources of the Arctic shelf.

The huge investments that in the long term will need to be directed to the identification, exploration and development of oil and gas fields in the Arctic shelf, as well as to the creation of accompanying transport and industrial infrastructure, should be compensated for by the receipt of corresponding oil and gas revenues.

Herewith, the amount of income should cover not only all types of costs, but also include excess profits due to the presence of high geological, climatic, environmental and economic risks associated with work on the Arctic shelf.

Of the fields discovered on the Arctic shelf, only half meet the accepted condition of profitability of 10%. These include 2 large oil fields – Prirazlomnoye (commissioned) and Dolginskoye. Two more oil fields – the large Medynskoye-Sea and the Medynskoye (medium in terms of reserves) – are classified as low-profit.

The total profitable oil reserves on the Arctic shelf today do not exceed 314 mln t, which does not allow for the time being to consider this region as a new large resource base for the oil industry.

Herewith, the profitable gas reserves of the Arctic shelf are located in a technically accessible zone for development and are concentrated in unique and large fields. Their volume is 7.2 trln cub.m (Table 4).

To assess the scale and economic significance of the hydrocarbon base of the Arctic shelf, it is important to have an idea not only about the explored part of it, but also about the potential value of the predicted oil and gas resources that have not yet been identified.

Herewith, it is necessary to consider the factor of the technical availability of these resources.

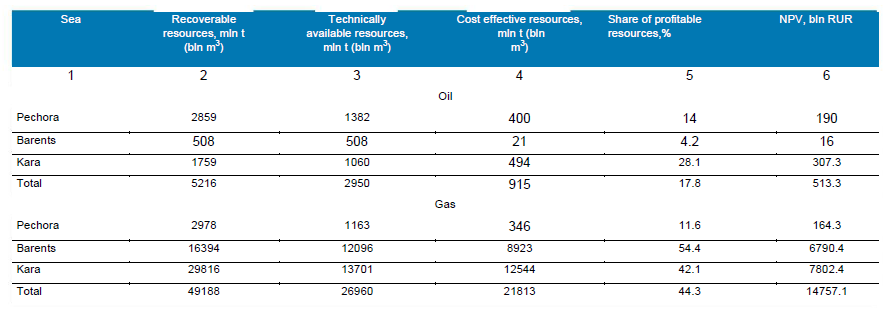

The results of VNIGRI calculations [3, 4, 5] show that at the current level of development of equipment and technology, out of the total volume of recoverable oil resources (5.2 bln t), about 3 bln t are technically available, and less than 1 bln t are profitable. Herewith, their maximum volume falls to the Kara Sea – 0.5 bln t versus 0.4 bln t in the Pechora Sea (tab. 5, Fig. 2).

The total net discounted income from the development of profitable oil resources is 513.3 bln RUR, including 190 bln RUR in the Pechora Sea, 16 bln RUR in the Barents Sea, and 307.3 bln RUR in the Kara Sea.

For gas, the ratio of recoverable and technically available resources is approximately the same (27 out of 49.2 trln cub. m), however, most of the technically available resources are considered profitable – about 22 trln cub.m (tab. 5, Fig. 2). The largest volume of profitable gas resources falls on the Kara Sea, which is explained by the forecasting of unique gas fields here. In second place is the Barents Sea. Herewith, the share of profitable resources in this sea is much higher than in the Kara Sea, which is due to the more favourable natural and climatic conditions for their localization.

Possible net discounted income from the development of profitable gas resources on the Arctic shelf is estimated at almost 15 RUR trln and is distributed mainly across the Kara (7.8 RUR trln) and Barents (6.8 RUR trln) seas. In the Pechora Sea, this indicator is significantly lower – 164 bln RUR. (tab. 5).

The profitability of local oil and gas facilities on the Arctic shelf varies widely and depends on the combination of their geological and climatic characteristics.

Herewith, the value of a unit of gas resources of similar in size local objects turns out to be significantly higher than oil ones.

The highest values for this indicator are typical for gas facilities with maximum resource estimates.

Only large and unique fields meet the minimum requirements for the development profitability (the rate of return is at least 10%).

The potential direction of gas supplies has a significant impact on the profitability of field development, since gas prices for domestic supplies are significantly lower than export prices. Accordingly, the focus on export supplies predetermines a higher level of economic assessment and, thereby, an increase in the profitability of the gas resource base.

The tax system acts as a separate factor affecting the economic performance of offshore projects. Tax incentives introduced for offshore projects have a very significant effect on the estimates obtained, increasing the volume of the profitable resource base.

Herewith, government revenues from the involvement of the Arctic hydrocarbon base in industrial turnover inevitably decrease. In the event of an increase in the tax burden, the profitability of hydrocarbon objects will decrease and a significant number of them and the corresponding resource base that they represent will “flow” from groups with high economic indicators to groups with lower efficiency, including the unprofitable group.

Conclusions

Russia, according to modern geological concepts, has as a huge potential source of hydrocarbon raw materials, mainly gas, on the Arctic oil and gas shelf.

The existing assessment of the hydrocarbon resource base allows, in principle, to count on achieving here in the long term the maximum annual volume of oil production of about 50-80 mln t, gas – 400-500 bln cub.m.

The pace and scale of the development of the Arctic shelf depend on the influence of a whole complex of external and internal Russian factors.

Above all, clarity is needed in maintaining the role of oil and gas as basic energy sources. The conjuncture of the world and domestic energy markets and the demand for Arctic oil and gas depend on this.

It should be emphasized that the acceptable profitability of large-scale industrial development of the Arctic oil and gas shelf is possible only at high prices for oil and gas (oil – 80–100 USD per barrel, and gas – more than 350 USD/thousand cub.m).

Large-scale development of oil and gas fields in the Arctic shelf requires the introduction of innovative technologies at all stages of the production process, including prospecting, exploration, field development and the delivery of oil and gas to consumers.

The investments necessary to solve this problem may turn out to be commensurate with similar investments, which at one time were directed to the creation of the West Siberian oil and gas complex.

Given the numerous investment risks associated with prospecting, exploration and development of oil and gas fields on the Arctic shelf and possible complications in the sale of the extracted products, it is necessary to refine the strategy for the phased development of its raw material base with its clarification after the completion of each stage, taking into account the situation in the energy raw materials markets.

Currently, the development of the Arctic shelf is at the initial preparatory stage. To complete it, it is necessary to complete a regional geological study of oil and gas areas and allocate areas for the preparation of promising structures. This will make it possible to assign subsoil areas located above the jurisdiction of the Russian part of the shelf to domestic oil companies. Herewith, work should continue on the creation of domestic technologies for the development of oil and gas fields in severe ice conditions.

The decision to carry out the subsequent stages of the development of the raw material base of the Arctic shelf should be made depending on the current situation in the world and domestic markets for energy raw materials.