Anatoly YANOVSKY – deputy Minister of Energy of Russia, D.Sc. Economics, CES

Eastern Route

This past October, Russian Railways OJSC (RZD) provided Russian coal miners with a discount in Q4 2019 on export-coal transportation with transshipment in Russia’s northwestern ports in order to maintain transportation volumes. With this discount, Russian Railways seeks to support the underloaded western direction instead of the overloaded eastern direction, which exports Russian coal to the markets of the Asia-Pacific Region.

The desire of Russian Railways to support exports to the west indirectly emphasizes the historical importance and high profitability of Asian markets. Northeast Asia is developing especially dynamically in the Asia-Pacific Region: China, the Republic of Korea, Japan and Vietnam.

The People’s Republic of China is becoming the main partner of Russia’s international cooperation in all economic areas, including in the field of coal. Already in September 2010, the Russian Ministry of Energy and the PRC State Energy Administration developed a common roadmap for cooperation in the coal sector, which is regularly updated and represents a document of strategic cooperation between the coal miners of the two countries.

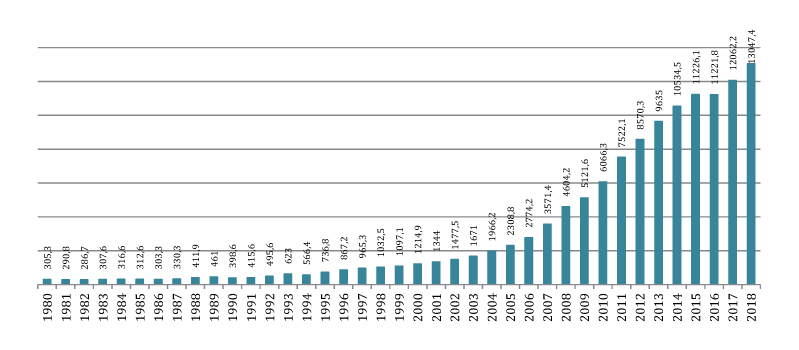

China’s production in 2018 exceeded 1.8 bln tons oil equivalent

(3.55 bln tons), which represents 46,2%

of global coal production

China is, without exaggeration, one of the leaders in the modern world market. The significance of this economy is well illustrated by the growth rate of the country’s nominal GDP. According to the International Monetary Fund, over the past ten years, it has grown by a factor of 2.8, and in 2018 exceeded 13 trln dollars, which represents 16% of global GDP.

Source: data from the Ministry of Energy, IEA, National Bureau of Statistics of the PRC

China’s production in 2018 exceeded 1.8 bln tons oil equivalent

(3.55 bln tons), which represents 46,2%

of global coal production

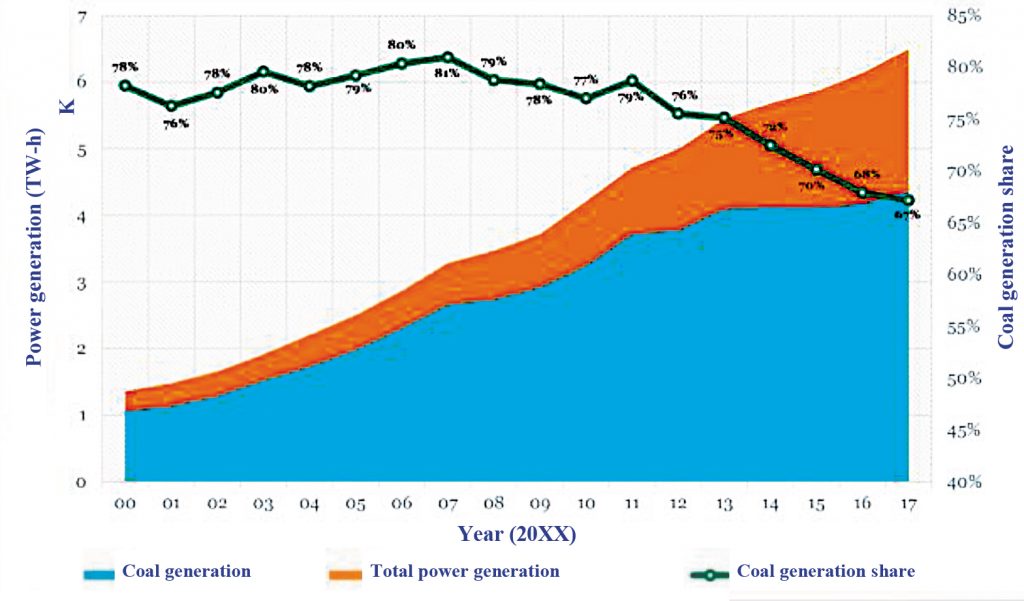

The development of the Chinese economy, as in other countries of the Asia-Pacific Region, was greatly facilitated by the active and thoughtful use of available energy resources, and, above all, coal. For many decades, coal generation has been and remains in Asia-Pacific countries the foundation of the electric-power industry, providing economic growth and industrial development. Coal is still the dominant energy carrier in the fuel balance of China, as well as in other Asian countries such as India. Traditionally, the growth of this industry has been promoted by the relatively-low costs of coal as an energy fuel, high employment in coal-mining regions and the energy-security level due to its good supply of reserves.

Today, coal generation is facing serious challenges. Most developed countries are tightening their contamination-control (low-carbon) requirements. Europe is actively introducing carbon trading and has announced its plans to completely abandon fossil fuels. In the fight for environmental safety, coal companies are the first to suffer. Of course, today’s emissions from coal combustion are much higher than that generated from using alternative energy sources. On the one hand, this is stimulating coal generation to become cleaner and more maneuverable, while on the other, it’s causing many investors to stop financing coal-generation projects.

Given these factors, most analytical institutions are confident in a future reduction in the share of coal generation in the world: from 37–38% in 2018 to 20–25% by 2040. Yet, at the same time, coal-fired generation is projected to increase from 9.3 TW/h to 9.4–11.2 TW/h, meaning that the share of coal will decrease not through a reduction in actual volumes, but due to the growth of commissioning capacities with other types of energy carriers.

Chinese coal miracle

China is incredibly rich in coal. According to data from the National Bureau of Statistics of China, about 138.8 bln tons of proven coal reserves are located in the country (according to BP – 131 bln tons). According to this indicator, China ranks 4th in the world, behind the USA, Russia and Australia. China is both the largest importer and the largest producer of coal. Its production in 2018, according to BP, exceeded 1.8 bln tons of oil equivalent (3.55 bln tons), which represents 46.2% of global coal production. At the same time, Russia is only the third importer of coal to China after Australia and Indonesia.

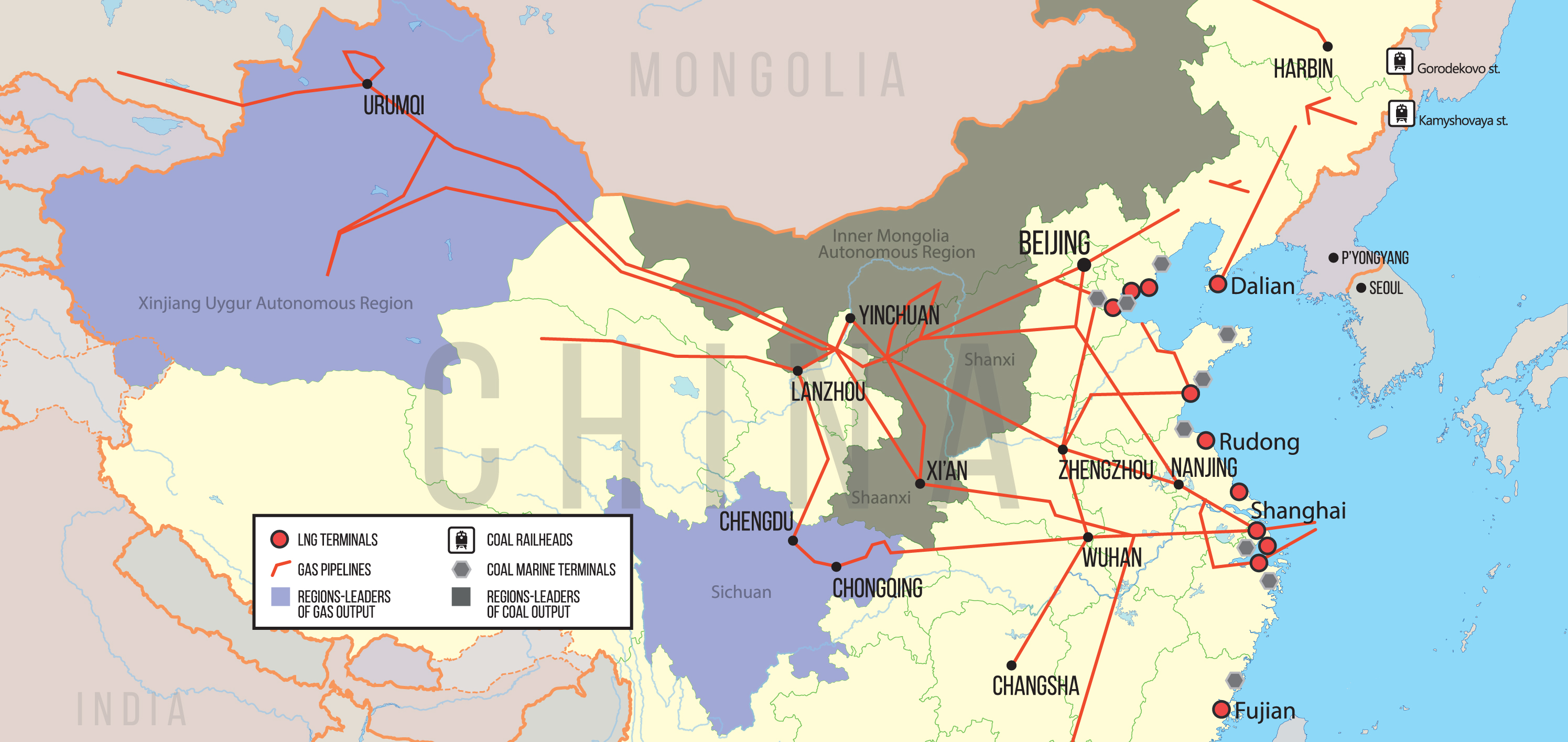

Coal mining is carried out in the territory of 27 regions, about 10 thousand mines and open-pit mines operate, 90% of which are low-power facilities. Shanxi and Shaanxi Provinces, where the largest state coal mines are located, as well as the western part of the Inner Mongolia Autonomous Region, produce about 60% of China’s coal. The country’s largest coal mine is Shenfu-Dongsheng, located on the border between Inner Mongolia and Shaanxi Province. In general, reserves are mainly in the western and northern regions – poorly developed and environmentally vulnerable.

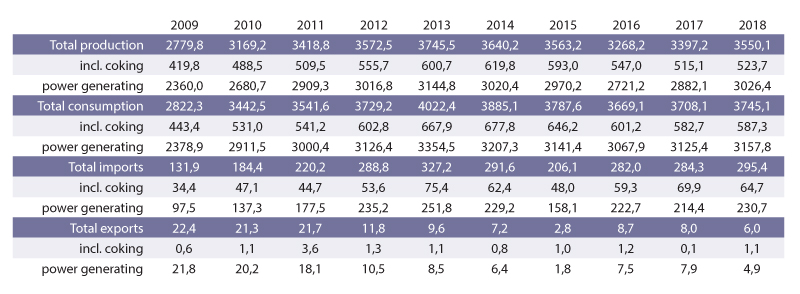

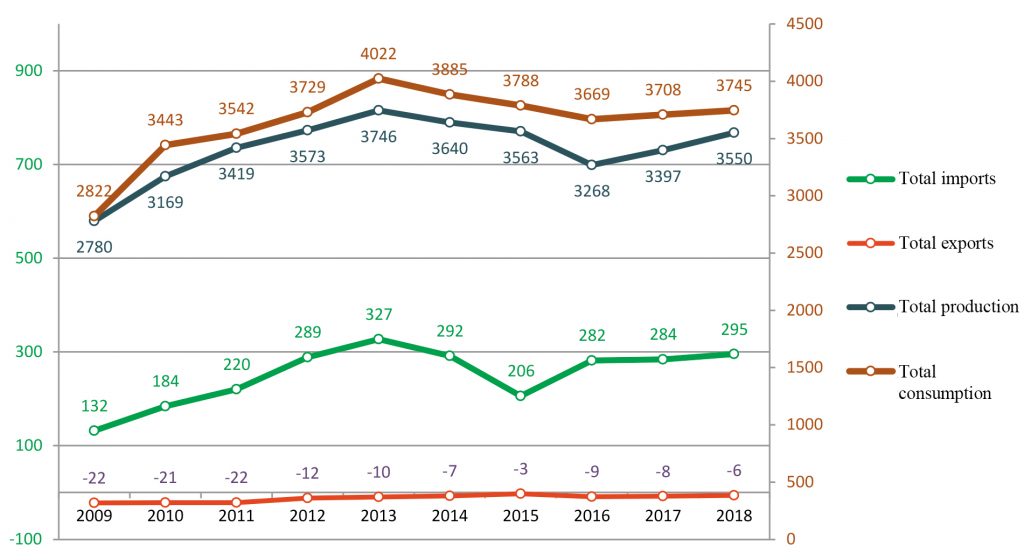

It is precisely the environmental demands of the public that have become the main reason for the pessimism of many analytical institutions regarding the future of coal in China. On the production side, China also continues to be the largest economy in the world in terms of coal-consumption levels – over 1.9 bln tons o. e. (more than 50% of world consumption). However, this indicator has been gradually falling since 2013, when the accelerated development of hydropower and other renewable energy sources began to bear fruit.

Source: UN

Despite the approaching greening of the Chinese economy, according to CoalSwarm, as of September 2018, about 259 GW of the country’s coal-generation projects were still in the engineering or construction stages, representing 25% of the installed capacity of China’s existing coal-steam plants. Coal still accounts for 58.3% of primary energy consumption, largely utilized for electric-power and heat generation at TPPs.

Peak growth in coal demand came in 2009, when the global economic crisis forced China to switch to a cheaper type of fuel. From 2000 to 2013, the growth rate of coal generation was phenomenal – over 13 years, the production of electricity from coal quadrupled. At the same time, the majority of the demand for coal is being created by the northern regions closest to the export channels of Russia and Mongolia.

China now faces a difficult task: maintaining its growing pace of economic development and standard of living while preventing a high dependence on imports of raw materials and the environmental degradation of the country. Together, all of these factors are leading to the need to revise the country’s «energy boiler».

in 2009-2018, mln tons

Source: Coal Information

Dynamics of coal production, consumption, import and export in China in 2009-2018, mln tons

Source: Coal Information

Towards a clear future

With the country’s active industrialization, the purity of atmospheric air has become a socio-political factor in China.

In 2013, Chinese Premier Li Keqiang declared a «war against air pollution» – and since then, coal consumption has gradually begun to decline. At that moment, the output of power plants was reduced, and the country’s major cities completely lost their previously-vital coal-fired power plants. The last of these plants was closed in 2017 in Beijing.

However, the process of toughening environmental legislation in China is far from unexpected. From1996 to 2012, emission requirements were tightened at an average of 5.5 times for nitrogen oxides, sulfur oxides and ash. On average, according to environmental organizations, the range of acceptable values of concentrations of hazardous substances in the air decreased 3–6 times for oxides and 300 times for ash.

Source: Rosinformugol JSC acc. to BP

Technically, the full-scale process of decarbonisation of the Chinese economy was launched in September 2013 with an action plan to prevent and control air pollution for 2013–2017. Today, this process is already underway within the framework of several strategic documents, first and foremost, the new version of the action plan for 2018–2020, adopted in 2018. In this regard, the goal is to reduce coal consumption in majorities by 10% by 2020. A little earlier, in 2016, the Chinese government adopted the 13th five-year plan for the period 2016–2020, which, in order to solve the problem of air pollution, established the goal of reducing the dependence of Chinese energy on coal to 58% by 2020 compared to 64% in 2015. In addition, environmental standards and greening requirements for Chinese energy regulate the environmental standards of the XIII five-year plan, the action plan for combating air pollution for the Beijing – Tianjin – Hebei Region for 2017–2018, the clean-heating development plan for Northern China for 2017–2021, the «battle for blue skies» plan for 2018–2020, and other documents.

Sources: IEA, BP Energy Outlook

As expected, the PRC government will continue to reorganize the coal industry; for example, it will close 4,300 retired mines with a total production of about 700 mln tons of coal per year. At the same time, it states that coal consumption will remain at 4 bln tons per year. That said, preferences will be granted for projects involving the production of methane from coal. According to the last five-year plan, the total capacity of coal-fired power plants should be limited to 1.1 bln kW by 2020.

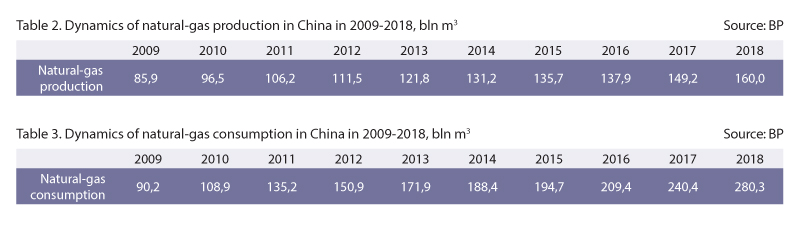

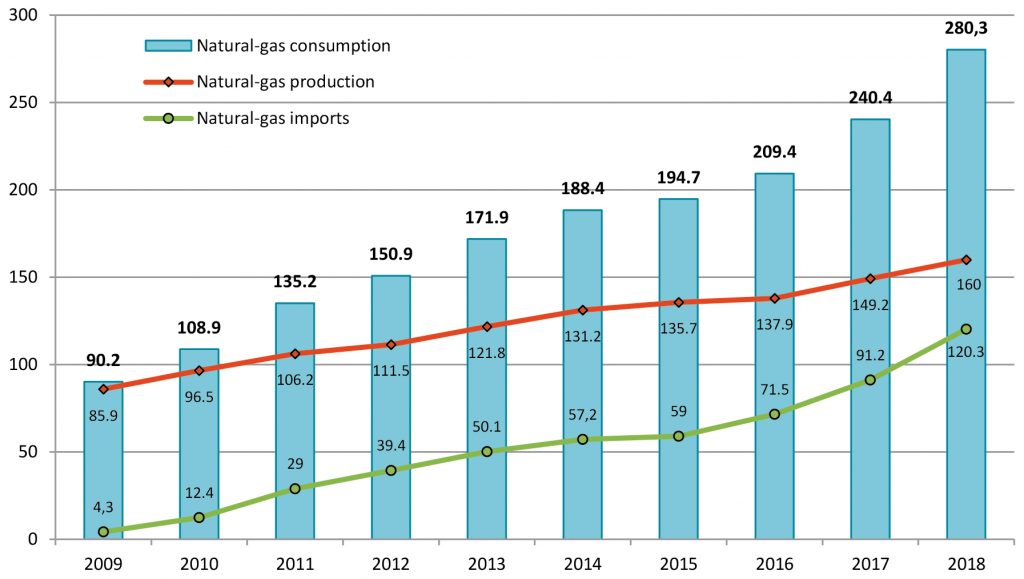

In China, under the slogan «Make China’s Skies Blue Again,» natural gas, along with hydropower and RER (Renewable Energy Resources), could emerge as the cleanest energy resource in the fight against air pollution. Natural gas occupies a small-but-significant role in China’s strategy to solve environmental problems. For this reason, the XIII Five-Year Development Plan of the Chinese economy aims to increase the share of gas in the country’s power balance to 10% (in terms of the gas industry’s development; a lower-level document specifies a range of from 8.3% to 10%) and to 15% by 2030. It is only in recent years that appropriate measures have been established, among others, the Strategic Action Plan for Energy Development.

Of course, the fulfilment of the energy plans of the Celestial Empire will only contribute to the growth of natural-gas demand in subsequent decades. According to the forecasts of the Institute of Energy Economics of Japan (IEEJ), the volume of natural gas consumption in China will increase from 283 bln m3 in 2018 to 321 bln m3 by 2020. Plans call for the country’s increase in gas production by 2023 from the current 161 bln m3 to 231.5 bln m3, and by 2030 – to 340 bln m3. At the same time, gas imports for this entire period should not exceed 50% of all consumption in the country.

At the moment, China is systematically following its own doctrine in terms of the priority of production over imports. At the end of 2018, the ratio of China’s own gas production against imports amounted to 57.5% vs. 42.5%, with a total gas consumption of 280.3 bln m3 per year.

in China in 2009-2018, bln m3

Source: ВР

Against the Grain

No matter what, it won’t be easy for China to fully comply with all of the rules. «Gas parity» may be violated due to faster growth rates of consumption (18% per year) and imports (+ 34% or 31.4 bln m3) compared with the growth rate of domestic production (just 8% in 2018). Just for the period of January-September 2019, gas imports to China grew by 10.8% to 98.3 bln m3 compared to the same period last year. According to BP, proven gas reserves in China stand at about 5.48 trln m3, that is, no more than 2.8% of the world’s.

In addition to the reserves limit, there is another problem – the need for the rapid construction of new gas-fired TPPs. At the moment, there are not so many gas-fired TPPs in the country. The main gas reserves in the country are concentrated in the Xinjiang Uygur Autonomous Region in the northwest of the country, as well as in Sichuan Province (Sichuan Basin), while the largest gas consumption is in the east and southeast of the country – in the provinces of Jiangsu, Zhejiang, Guangdong and Shanghai City. In 2009, China established stable supplies of pipeline gas to the country’s market from Turkmenistan (35.5 bln m3 of gas in 2018), Uzbekistan (6.9 bln m3) and Kazakhstan (6.2 bln m3). Since 2013, Myanmar has been supplying gas to China. Last year, it delivered 2.9 bln m3. In 2018, about 41% or 51.5 bln m3 of all imported gas was delivered to the country through pipelines.

Source: Platts, Reuters, MEA

A significant share of gas imports still comes from liquefied natural gas (LNG), which accounts for more than 59% (about 68 bln m3) of China’s total gas imports. It is delivered to the eastern regions of China; its main suppliers are Australia, Qatar, Malaysia, Indonesia and Papua New Guinea.

This situation, however, could be offset by the accelerated development of unconventional shale-gas reserves. According to IEA estimates, China’s recoverable shale-gas reserves amount to 31.2 trln m3, which ranks the country first in terms of this indicator in the world. According to the program for the country’s development of shale gas, its production should reach 60–100 bln m3 by 2020.

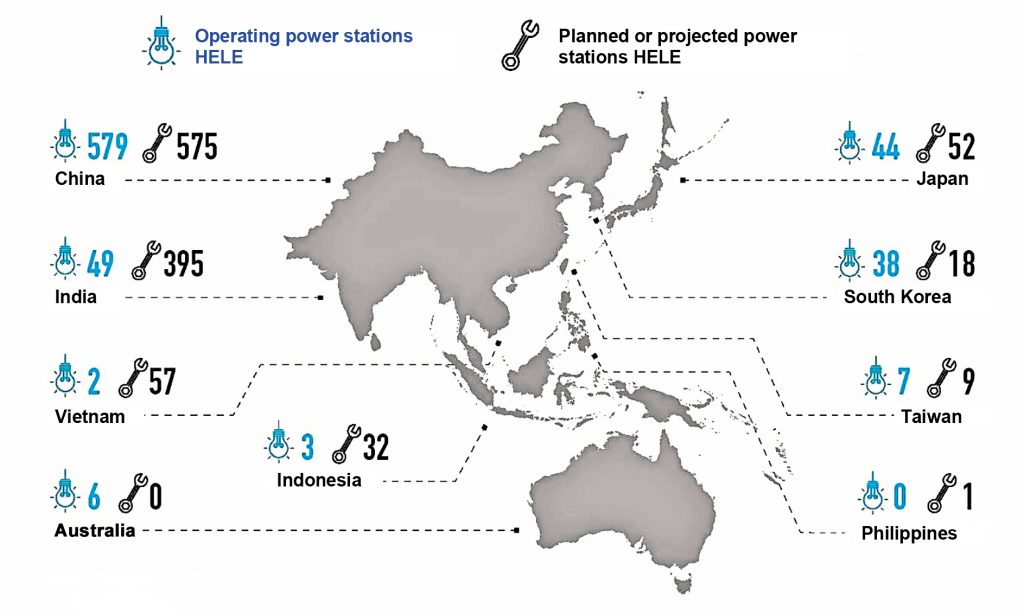

The main question here is: how quickly can China fully adopt the latest technologies to accelerate an increase in coal use? And is it really necessary to substitute fuel when coal technologies, under the pressure of competitors, are becoming cleaner? Despite the increasing competition between coal and gas, the share of coal generation remains quite high in the Chinese energy market. At the same time, China is becoming a world leader in applying clean coal technologies. About 580 coal-fired power plants operate in China on HELE principles («high efficiency and low emissions»), and their number could double in the future. These power plants will use higher-quality coal with a high calorie content and low ash and sulfur content.

Sources: FCS of Russia, calculation by Rosinformugol JSC

It is this environmental and technological factor that plays a decisive role in increasing the supplies of Russian coal to China. Moreover, meaningful prerequisites exist for the further ramp-up of Russia’s total coal exports.

For a long time, Russian coal exports were oriented towards the Atlantic coal market. But since the 2009 crisis, domestic coal miners have begun expanding cargo flows to the east, developing, among other things, the Chinese coal market.

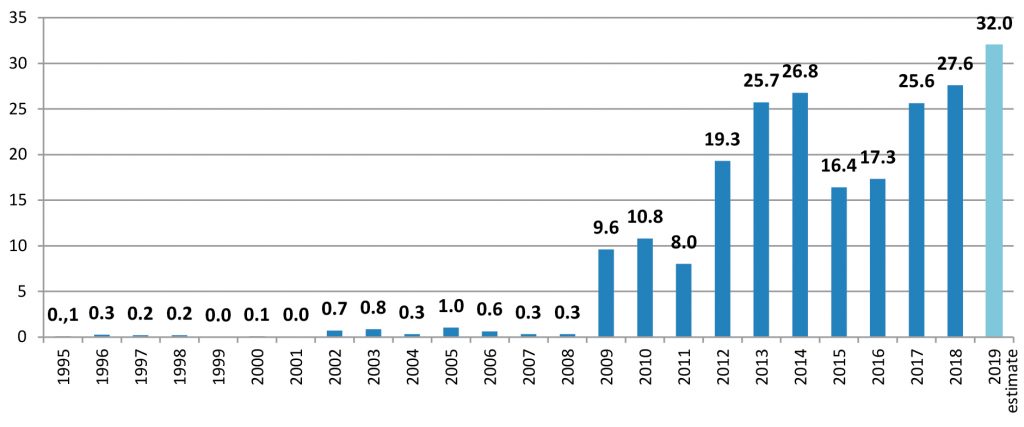

Russian coal companies are becoming important suppliers of high-quality energy and coking coal for Asia-Pacific countries. In 2019, more than 100 mln tons of Russian coal will be sent to this emerging market. Of this volume, China accounts for a full third. Despite the decline in 2015–2016, supplies to the PRC have been showing steady growth for a second year. If export volumes of Russian coal to China in 2008 amounted to only 0.3 mln tons, then this year, after only 10 years, they will exceed 30 mln tons, which represents 14% of Russia’s total coal exports and 10% of total coal imports to China. In the ranking of the largest importer-countries of Russian coal, China confidently takes a leading position along with South Korea and Japan. Moreover, it is precisely such countries as China that allow Russia to steadily hold the third position (after Australia and Indonesia) in the ranking of the world’s largest coal exporters.

The development of economic relations with Russia is leading China to use significant volumes of our country’s fuel resources. We are becoming significant suppliers not only of oil, but also of coal, and since the beginning of December of this year – of gas as well. According to the contract signed between Gazprom and CNPC on May 21, 2014, the Power of Siberia gas pipeline will supply 38 bln m3 of gas per year over the next 30 years, with a contract value of up to $400 bln. It should also be noted that the project will only operate at its full capacity in 2025. The beginning of long-awaited gas supplies is essentially launching the long process of inter-fuel competition between coal and natural gas already tested in many countries of Europe and North America.

Shipment volumes through overland borders in 2015–2018 increased by a factor of 5.8 from 1.5 mln tons to 8.84 mln tons In future, these shipments may grow exponentially

Unlike other importers, Australia in particular, Russia has a short transport leg to deliver coal to ports in China, and also retains the possibility of delivering Russian coal both by sea (accounting for roughly 2/3 of all exports) and via railway overland borders. Shipment volumes through overland borders for the period 2015–2018 increased by a factor of 5.8 from 1.5 mln tons to 8.84 mln tons. In future, these shipments may grow exponentially.

In 2014, import duties on coal (anthracite, coking and power-generating) in the amount of 3–6% were introduced in China. At the same time, these duties do not apply to other large suppliers of coal to China (Indonesia, Australia).

Issues related to the non-discriminatory access of Russian coal to the Chinese market, including with respect to the regulation of sampling, will be solved by Russia in close cooperation with its Chinese partners as part of the roadmap’s implementation. The possibility of abolishing import duties on coal from China, which is a quasi-restraining factor in the growth of Russian coal exports to the Chinese market, is currently being studied.

China’s energy policy is in good balance – despite the implementation of rather strict environmental plans, the Chinese leadership understands the profitability and effectiveness of the technological development of the coal industry. In this regard, Russian coal will hardly face new discriminatory rules or tightening conditions on the Chinese market. On the contrary, Chinese companies are actively developing both imports and business partnerships in general. Thus, an important role will be played by the results of cooperation between EN+ Group (on the Russian side) and China Energy (on the Chinese side) on the joint development of the Zashulan coal deposit in the Trans-Baikal Territory and other adjacent coal deposits, as well as on the exploration of opportunities to develop supplies of Russian coal to China and Chinese-made equipment to Russia.

Energy cooperation between Russia and China in the gas and coal sectors could be promising in the nearest future. Russia’s raw material potential and, above all, the qualitative characteristics of its coal products, make it possible to squeeze competitors from the Asia-Pacific Region on the Chinese market and, over the next ten years, to increase annual export deliveries to the country even higher – up to 55 mln tons. There is confidence that China’s intent to diversify its import sources, while working on adapting existing import channels to emerging global environmental requirements, and considering the general historical experience of cooperation with Russia, suggest that the emergence of a gas component in Russian-Chinese relations will only lead to a closer and more profitable cooperation of the two countries in the global energy arena.